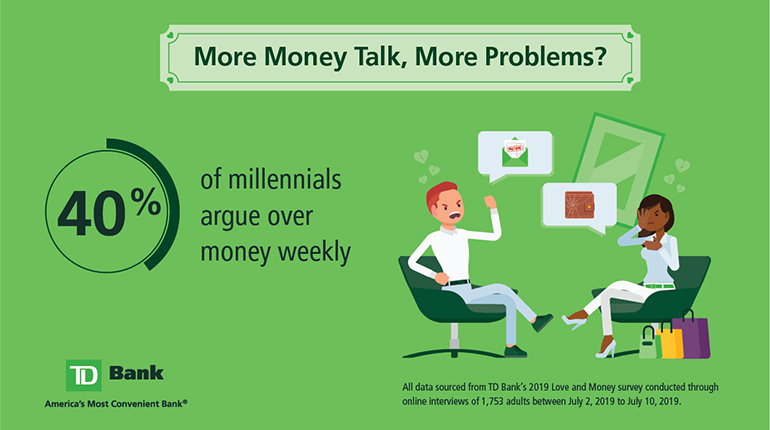

Since the very first Love & Money survey was released in 2015, communication between millennials talking about finances with their partners is up 21%, more than other generations. Now, almost all millennial couples (94%) discuss the subject together at least once per week. However, the survey found millennials are still more likely than other generations to argue with their significant others about money. Nearly 40% of those ages 23 to 38 admit to fighting about finances at least once a week, up four percent from 2015, while 14% of Gen Xers and five percent of baby boomers say they argue about money.

"It's important that couples are honest and open about their money challenges. Often times a partner will hide a credit card bill or low score due to guilt or embarrassment, yet when the debt comes to light it’s often not the debt that creates the conflict - it's the secrecy,” said Rachel DeAlto, relationship expert, coach and television personality. “If you want to maintain trust with your partner, own it and create a plan to improve your financial situation.” Click here to learn more about the 2019 Love & Money Survey.

|

|

|---|

Blog: How to Have the 'Money Talk' With Your Partner

Blog: When Two Become One: How to Manage Joint Accounts After Marriage

Blog: Why Money Talk Can Be Good for Relationships