The TD Direct Investing Index is designed to be an educational tool that seeks to measure the attitude and behaviour of self-directed investors in the prior month and present it in a format that is easy to read and understand. By looking at this historical activity, it can help us see how investors reacted to economic and financial market events. In this instalment, TD Direct Investing shares insights on investor sentiment based on the behaviour of self-directed investors in October. Highlights from October include investor confidence being largely propelled among Boomer investors supporting more conservative energy stocks, while Millennials were willing to take more risks, focusing on next-generation companies across industries with larger social footprints. Read the full report below.

The historically volatile month of October ended with a surprisingly positive sentiment of +52, moderately up from last month's reading of +37. October sentiment sits firmly in bullish territory. Remember, the sentiment score is on a range from -100 (most bearish) to +100 (most bullish). Likewise, the TSX was up 3.7% in the same month. In October, we also saw an interesting trend emerge in investor confidence: the generational divide. There was strong demand for both old and new guard securities, with Boomers rocking it old school, and Gen Z and Millennials getting in their feelings with the next generation of companies.

Grey Power

Energy sentiment continued to lead confidence in all sectors for the second straight month. At +19, energy benefited from strong price appreciation in oil and natural gas markets. Energy supplies were still constrained globally and combined with the demand surge on the back of a rebound in global mobility, more pressure was placed on prices.

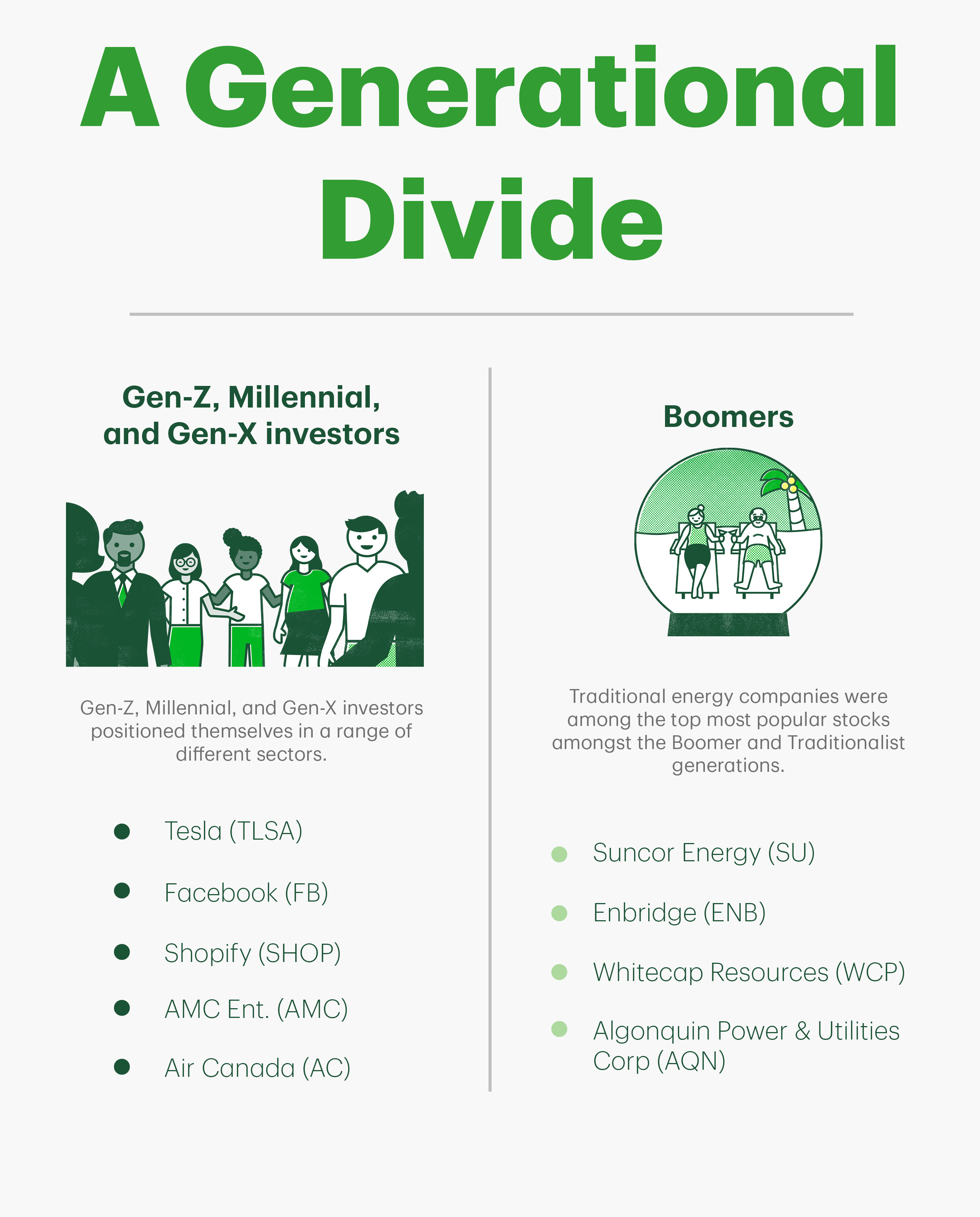

How did the generations respond? Traditional energy companies Suncor Energy (SU), Enbridge (ENB), and Whitecap Resources (WCP) were among the top 5 most popular stocks amongst the Boomer and Traditionalist generations. The closest they got to next gen firms was Algonquin Power & Utilities Corp. (AQN – Utilities sector), which has positioned itself in the t renewable energy space. Make no mistake: all age groups pushed this sector and these securities up the ranks. The younger generations were simply more focused on high growth stock in other sectors while the Boomers and Traditionalists focused on these stable, dividend stocks. Geographically, this same trend of 'trade where you live' emerged, with energy stock demand most apparent in the energy-exposed provinces of Alberta, Manitoba, and Saskatchewan.

We Are (All) Living in a Material World

The materials sector was the next most popular sector, up 37 points to +12 sentiment, as industrial and precious metal companies saw strong investor demand. Popular names were Barrick Gold (ABX), Lithium Americas Corp (LAC), and Teck Resources (TECK.B). We would classify the improvement in sentiment as broad-based. In other words, the generations agree: this is a materials market. All investor age groups showed improved sentiment, with Boomers showing the greatest improvement. In terms of trading style, long-term Investors favoured materials, though active traders also rode the wave (to a lesser degree). The provincial breakdown was a little bit more obvious, as investors in Ontario, BC, and the Territories showed the greatest improvement in sentiment in this sector.

YouthQuake 2.0

When it comes to the companies positioned for the future, Gen-Z, Millennial, and Gen-X invested in a range of stars in different sectors such as Tesla (TSLA - Consumer Discretionary), Facebook slash Meta Platforms Inc. (FB - Communication), with a dash of Shopify (SHOP – Technology). Both Tesla, which soared to a $1 trillion valuation on the back of an expected jump in new car sales, and Meta, with negative coverage of its societal impact then its subsequent tilt to the metaverse, were getting lots of digital media ink in October. More interesting (correlation not causation) is these companies have huge social footprints, which is where younger investors comfortably spend more time than their older investor counterparts.

Elsewhere in next gen: recent top picks, like AMC Entertainment Holdings (AMC – Consumer Discretionary) and Air Canada (AC - Industrials) were holding in the top 5 but were sliding in popularity. Active Traders and those in Quebec, Ontario, and BC were also big into next generation stocks.

The Big Reveal

So. Were older generations more conservative with a focus on wealth preservation and younger generations ready to take risks on innovation? Yup. October's numbers seem to say as much. What was perhaps more interesting were the layers on top of that - some of the factors which may have driven investor decisions, from familiarity (buy what you know) to home bias (buy where you live). And dare we say - to hopes and dreams (buy the world you wish for).

For monthly updates about market sentiment among self-directed investors, visit the TD Direct Investing Index.