Talking money with your partner may not feel like the most romantic conversation, but it sure is important.

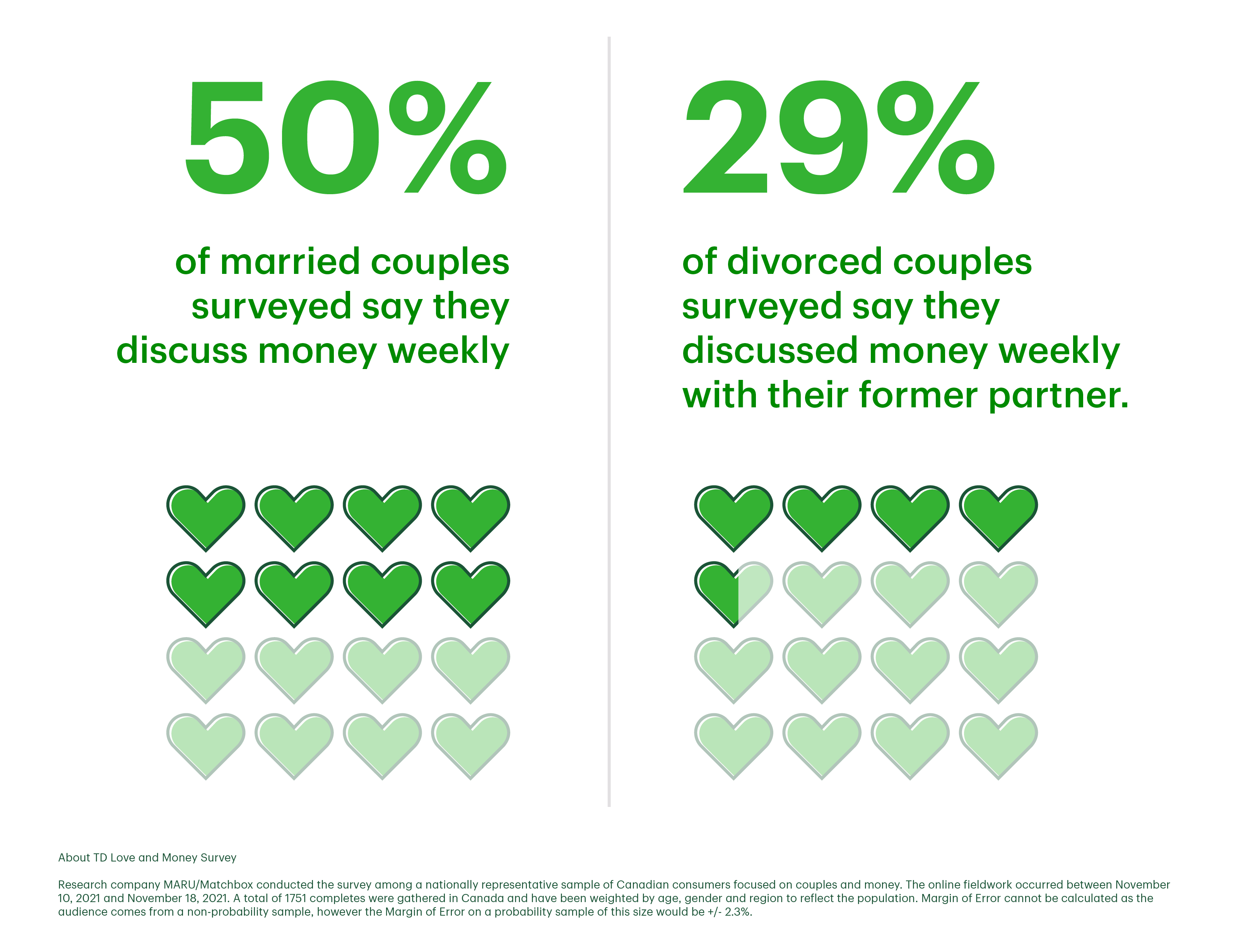

In fact, not talking about finances at all or on a regular basis in a relationship could play a role in its breakdown. According to a new survey from TD, divorced couples surveyed are less likely to have discussed money during their marriage, with 29% of survey respondents saying they only discussed money weekly with their former partner compared to 50% of married couples surveyed.

When it comes to financial discussions with your partner, it is generally a good idea to have regular and frank discussions on key aspects of money management, from who pays the bills and how much money to keep in your emergency account, to retirement planning.

These kinds of discussions are especially important if you're planning to take a major step in your relationship, such as moving in together, getting married, or buying a house.

While it might feel a little awkward, talking about money could have a big payoff: You'll both find out if you’re on the same page financially, if your values around money differ, and if you can work together towards major financial goals.

Here are 10 questions to consider asking your significant other to help get the money conversation flowing.

What are your overall financial goals?

Think of this question as a non-threatening conversation starter to learn more about your partner's overall financial priorities. It's basically a way to get an idea of what they like to spend money on, what they care about financially, and whether their financial values and goals align with yours. Do they want to go back to school, start a business or eventually buy a house and have kids (and if so, how many)?

How do you feel about sharing your financial information now?

To plan a financial future together, it's critical to have a clear picture of your partner's income, credit score, assets and liabilities. How your partner responds to these questions and what you discover about their financial behaviours can give helpful clues to the type of financial future you can expect together. If your partner feels unready to share this information right now, you can volunteer to go first. If they’re still hesitant, you may have to dig deeper to find the source of their reluctance before your partner feels safe sharing that information. If they persistently refuse to reveal anything about their finances, it could be a sign of possible future problems concerning your financial future together.

How much debt do you have?

This includes student loans, auto loans and consumer debt from credit cards or personal lines of credit. If your partner is carrying a low amount of manageable debt, that's likely nothing to worry about. But a huge debt load is likely another story. It could mean your partner has a money management problem and may incur more debt in the future, and that a lot of your household income will be going to debt repayment rather than building savings.

What are your feelings on combining finances?

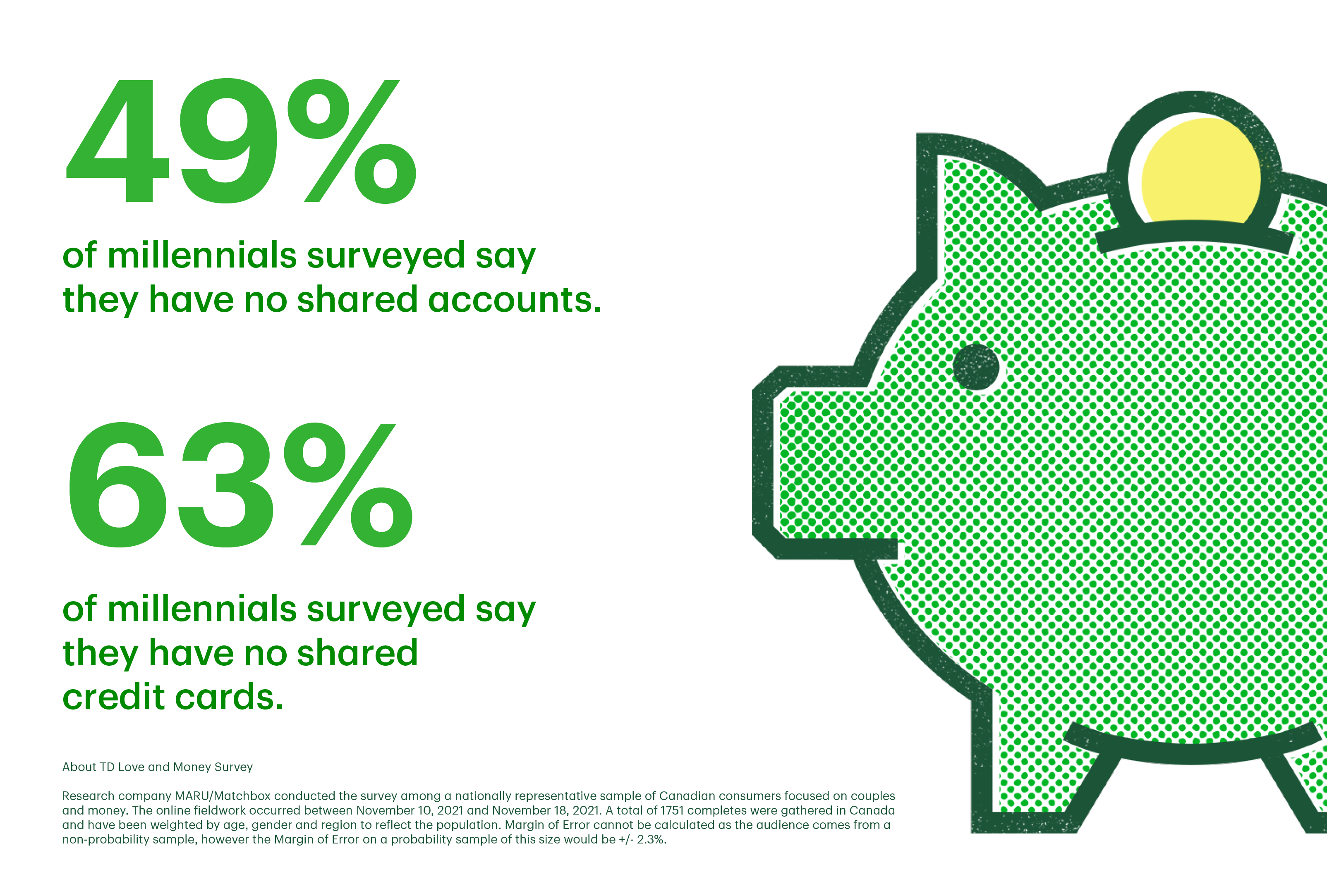

Couples don't necessarily have to have a joint bank account. In fact, many couples opt to keep their accounts separate, or open one joint account for common expenses, but keep separate accounts for everything else. In fact, among younger generations, this kind of separation is becoming more common. According to the 2021 TD Love and Money survey, of those respondents in committed relationships, millennials are more likely than other generations to keep their money separate from their partner, saying they have no shared accounts (49%) and no shared credit cards (63%).

Whatever your preference, it's good to find out each other's views on this topic at the start so expectations are clear and you're not potentially arguing about it later.

Do you want to own a home one day, or do you prefer to rent?

Home ownership is a huge financial commitment. It involves saving for a down payment, and then regularly making mortgage payments for many years. On the flipside, once you've paid off the mortgage, you own a significant asset. However, not everybody is willing to commit to this kind of long-term obligation. If you're set on owning a home while your partner is content to rent, it's best to know that at the start.

What are your retirement goals?

This is a good way to touch base on what type of retirement your partner sees in their future, how early they plan to retire, and whether they have any retirement savings. It also helps you gauge whether your spouse-to-be makes saving for retirement a financial priority, say, by maxing out their registered retirement savings plan (RRSP) contributions each year. The answers to this question will help you understand how closely your partner's vision for retirement is in sync with yours and help you map out a retirement plan that accommodates both of you.

How would you describe your spending habits?

Some folks like to live in the moment, splurging on things like restaurant meals, travel, concert tickets or clothing. Others like to save at every opportunity – redeeming coupons, shopping around for deals and waiting for items to go on sale. If one of you tends to carry a credit card balance each month while the other pays cash for everything, you could be headed for conflict. Asking this question at the start could help you discover where your partner falls on the spending spectrum, if your spending habits intersect and where they diverge, and whether each of you can live with the differences.

How would we manage the finances and pay the bills if we got married or moved in together?

Deciding who is in charge of paying what is an important part of money management as a couple. From common, day-to-day household expenses such as groceries and utilities to mortgage, insurance and car payments, how are the two of you going to look after this? One way could be for one partner to handle the day-to-day expenses such as groceries and bill payments while the other looks after the long-term commitments such as the mortgage, insurance payments and investments.

Do you owe money to family or friends?

It's great to have family and friends to fall back on when times are tough. However, if your partner owes money to family and friends, you might want to find out why. What is the money your partner received being used for, and do they have a plan to pay it back? Is this an isolated event, or part of a larger, common pattern of constantly borrowing money? Do they pay back on time or are slow to do so – or is there no intention to pay it back at all? Depending on the answer, it may be worthwhile to spend more time to discuss this matter before proceeding with your plans.

Have you ever declared bankruptcy?

You deserve to know this information, as it could affect your ability to secure a loan or mortgage as a couple. Following up with questions on the context of the bankruptcy (was it job loss or illness vs. careless money management) can be useful to determine your partner's potential credit risk down the road.

Once you have the answers to any one or more of the above questions, you will likely have a clearer idea of what each of you will bring to the table as you plan your future together.