Melissa Firth spends a large portion of her day initiating uncomfortable conversations.

Firth's job is to field calls and reach out to customers who need help with everything from everyday personal banking questions to small business financing.

Often, her first obstacle is simply getting customers to open up and talk candidly about money.

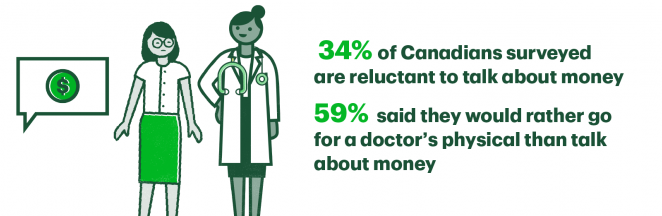

Research finds that many Canadians are apprehensive about discussing their financial situations. According to a recent Ipsos poll conducted on behalf of TD in conjunction with the 10-year anniversary of Financial Literacy Month, roughly 34% of Canadians surveyed said they are reluctant to talk about their finances, with only 31% of respondents saying they would seek help from their financial institution.

Nearly half (46%) of Canadian survey respondents also shared that COVID-19 has had a negative impact on their family’s financial situation – which when combined with their general reluctance to discuss finances - can create a real barrier to financial recovery and the ability to achieve financial goals.

That's where advisors like Firth come in. The TD Ready Advice Centre is a resource dedicated to helping customers navigate the financial impacts of the pandemic. Advisors identify and proactively reach out to customers facing financial hardship due to COVID-19, providing personalized advice and help on a range of topics, including those found on the TD Ready Advice site.

In situations where a customer is reluctant to open up, Firth shares how she helps her customers feel more comfortable so they can speak more openly about their financial needs.

The Ipsos poll conducted on behalf of TD found that 34% of Canadians surveyed are reluctant to talk about money, and that 59% would rather go for a doctor's physical than talk about money. As someone whose job it is to get people to open up about their finances, how do you get people talking?

It's true that a lot of people are apprehensive when we first reach out. So, the first step is reassuring them that we're not calling to sell them something. We are very clear that we're reaching out to help them with their finances by first working with them to create a plan that is tailored for their situation. I'll give a couple of examples of more common things we can look at helping them with to see if they can relate to any of these situations, which sometimes helps them open up. Sometimes we use open ended questions. And once we get them talking, we make sure to genuinely listen to what they have to say, so that we can help address their specific situation.

What kinds of questions do you typically ask people to help them get over their initial discomfort with talking about money?

You have to start really simple. I like to start by asking how they're feeling about their ability to meet their financial goals. Do they feel confident about their financial situation? Are they worried about anything in particular? Do they have a plan? Do they think their current financial plan is working? From there, I usually ask them to talk to me a bit more about their particular areas of concern, being sure to consider and spend time discussing each concern as it comes up. A lot of people don't even realize they have questions or need more understanding of a topic until you bring it up with them. Finding out how they feel about different aspects of their financial situation can often help to uncover what their true needs are.

The same poll we mentioned earlier found that 28% of people surveyed aren't comfortable talking about finances because their financial situation isn’t great right now, while 9% said they were embarrassed to talk about their situation. If people are reluctant to talk about money, how do you make them feel comfortable enough to open up?

Like so many things, the more you talk about it, the easier it gets. I think a lot of people tend to avoid conversations that are uncomfortable or if they feel that no one can relate to them. When they avoid having the conversation, it can reinforce their feelings of isolation and insecurity, making it even more difficult for them to find a solution. Sometimes that insecurity comes from a lack of financial literacy, and because they don't understand something, they are afraid to ask questions because they think they should already know the answer. Asking questions when you don't understand something is so, so important, and should be encouraged by advisors to put their clients at ease so they can focus on understanding their options.

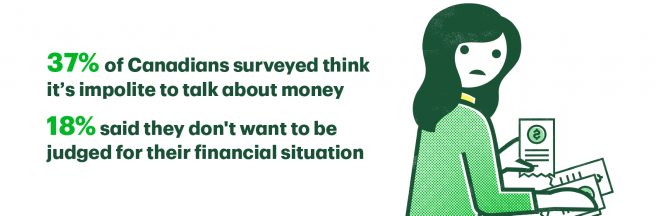

The Ipsos poll also said that 37% of respondents think it's impolite to talk about money, while 18% said they don't want to be judged for their financial situation. What are some of the more common reasons you hear for why customers are reluctant to discuss money?

A lot of people were brought up to avoid certain conversation topics, money being one of them. I find when reaching out to customers that a lot of them feel like they are beyond help or that there is nothing that we can do to help them. This can create a bit of a barrier to them wanting to discuss their concerns with us, as they are already anticipating a negative outcome.

For people who want to improve their financial literacy, what are the first steps you would recommend they take?

First, don't put it off. Take time to think about what you know and what you want to know. Then, ask questions and speak to people who are knowledgeable and can help educate you. TD offers a number of online resources through the TD Ready Advice Hub. The more you educate yourself about financial matters in general and your finances in particular, the more likely you are to build a feeling of confidence about your financial well-being.

TD provides a range of tools and programs aimed at helping Canadians live their lives with greater financial confidence:

- TD colleagues help deliver financial education programs in many communities, such as Money Matters, offered by ABC Life Literacy Canada and Your Money.

- TD MySpend is a mobile app that helps you track your purchases and transactions made from your personal TD Canadian dollar savings, chequing and credit card accounts and automatically groups them into categories, to help you understand how you spend your money.

- TD advisors are available at our over 1,100 TD branches across the country to help provide personalized financial assessments and help customers with their financial goals.

- The TD Newsroom provides a range of informative articles about personal finances, budgeting and fraud prevention.

- Students can now use a Student Budget Calculator to help them forecast how much their school year will cost for their post-secondary education.

- Learn more about how we are supporting Financial Literacy in communities across Canada and the United States by visiting The TD Ready Commitment Financial Literacy page.

- Visit the Financial Consumer Agency of Canada's site for tips and tools on budgeting.