Canadians point to money as our greatest stress, with research by the Financial Planning Standards Council in 2018 showing that over 48 per cent of Canadians say they’ve lost sleep due to stress over debt, managing household costs, saving for goals, and unexpected expenses. What we earn, spend and save doesn't just affect our bank account but is tied to our mental well-being.

TD is working with the Centre for Addiction and Mental Health (CAMH) on a series focused on how the relationship between financial and mental well-being is affecting the lives of Canadians. This series will also suggest some advice for individuals and caregivers on ways they can manage their financial and emotional well-being in an effort to help address some of the stigma preventing us from having healthier conversations related to money and mental wellness.

A diagnosis of Alzheimer's disease, a subtype of dementia, can be as life altering for the individual living with the disease as it is for their loved ones and caregivers.

According to the Alzheimer's Association, over 747,000 Canadians are living with Alzheimer's or another form of dementia—conditions that can cause memory loss and behavioural changes. Symptoms in early stages may be minimal but will eventually worsen as the disease progresses. Not only is an individual's mental and physical wellness impacted, but their ability to manage day-to-day responsibilities is affected as well.

When someone you care about is living with Alzheimer's disease, having conversations around issues that matter, such as their personal finances, becomes more critical than ever. Knowing how to approach the discussion and what measures should be in place can be crucial to their financial well-being.

Start early

Talking to those you love about their personal finances can be difficult, regardless of one's health status.

As signs and symptoms of early Alzheimer's disease can include forgetfulness, communication difficulties, and changes in mood and behaviour, having the initial conversation around money with your loved one is a discussion you want to have as early as possible.

"Ideally, you want the individual to still be involved in the decision making whenever possible," said Dr. Donna Kim, a geriatrics psychiatrist at the Centre for Addiction and Mental Health (CAMH) in Toronto. "This will likely be an emotional time for all those involved, so do not overload your family member with a series of questions or multiple requests in a single conversation (or at once)."

As your loved one's cognitive abilities may have begun to decline, you may have to repeat the same information a few times.

"Remember, your role is to help—not overwhelm," she said.

Gently approach the discussion

As you may need to have several conversations around finances, Dr. Kim says family members and caregivers should approach the subject with care and provide context for why this discussion is taking place.

"Let this person know that you have their best interest in mind, and you know that they have worked hard all their lives to accrue whatever it is that they have at this stage."

Dr. Kim advises telling your loved one that the reason for these discussions is to help ensure they're not taken advantage of financially in the future, and that you want to help ensure their assets are safeguarded and properly managed.

Confirm financial matters are in place

In your role as a caregiver, Dr. Kim says it may be important for you to have an accurate understanding of the state of your loved one's finances.

Ask if your family member has prepared the necessary documents, such as a power of attorney (POA) —and that the person appointed as the attorney under the POA is trustworthy and can help your loved one manage their finances in their best interest should the need arise.

"Make sure that all legal and financial documents are stored in a safe place so that you, or the attorney, know where they are located for future access if needed," stated Dr. Kim.

Set up automatic bill payments

For someone living with Alzheimer's disease, it can become increasingly common to experience difficulties with managing money. For instance, the individual may accidently miss paying bills or even make duplicate bill payments.

To ensure monthly expenses such as utilities, telephone or cell phone and credit card bills are paid on time and appropriately, suggest the person you love (or assist them as needed) sets up automatic bill payments from their bank account. This can help ensure that your family member's financial priorities aren't overlooked.

Pay attention to potential financial scams

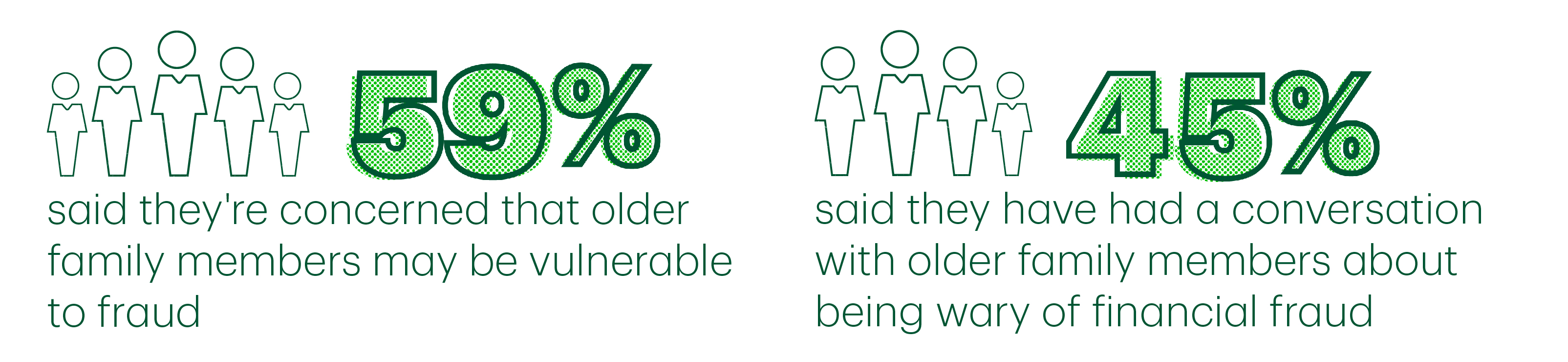

According to a 2019 TD Fraud survey, nearly 59 per cent of respondents said they're concerned that older family members may be vulnerable to fraud, and less than half of those polled (45 per cent) said they have had a conversation with older family members about being wary of financial fraud.

While it's important to talk to your loved ones about how they can protect themselves, their declining health can make it difficult for them to be mindful of scams. Learn how to spot some of the more common types of fraud—including romance scams, lottery scams, and the grandparent scam—so that warning signs or unusual transactions can be flagged and reported.

Ensuring fraud alerts are set up on your loved one's bank account can also help alleviate some of these concerns. Seniors can receive text messages that notify them if their financial institution detects suspicious activity made to personal banking accounts.

Don't do it alone

Taking care of someone living with Alzheimer's can be very challenging and difficult because the disease is a progressive condition that doesn't plateau or get better, says Dr. Kim.

"Regardless of the decisions you have to help make—whether financial or medical—it's important to get support and surround yourself with a network of people who can help relieve some of the burden," she said. "This way, you're not alone in having to make decisions on behalf of the person you care about and love."