Canadians are being targeted by fraudsters running fake taxi scams designed to take advantage of their victims' willingness to help others.

Police in several Canadian cities are warning people to beware of this debit and credit card-swap scam that appeared to increase during the COVID-19 pandemic and is still of concern today.

Here's an overview of the taxi fraud scam and some tips on how to avoid becoming a victim.

How does the taxi fraud scam typically work?

In this scam, there are often two scammers involved: one who poses as the driver of the fake taxi, while the other pretends to be a passenger who approaches the victim asking for help.

The fake passenger approaches the potential victim claiming the taxi driver won't accept cash as payment for a fare and asks if the victim can use their own debit card or credit card to pay the fare, with the fraudster offering to reimburse them in cash.

The victim then inserts their card into a modified point of sale (POS) terminal to pay the fare, and the machine records the PIN. The fake passenger then gives the victim cash to cover the "fare." At the same time, the fake driver swaps the victim's real debit card or credit card for a fake one, which is then returned to the victim.

Once the victim is gone, the scammers then use the stolen debit card or credit card and PIN to withdraw funds from the victim's account.

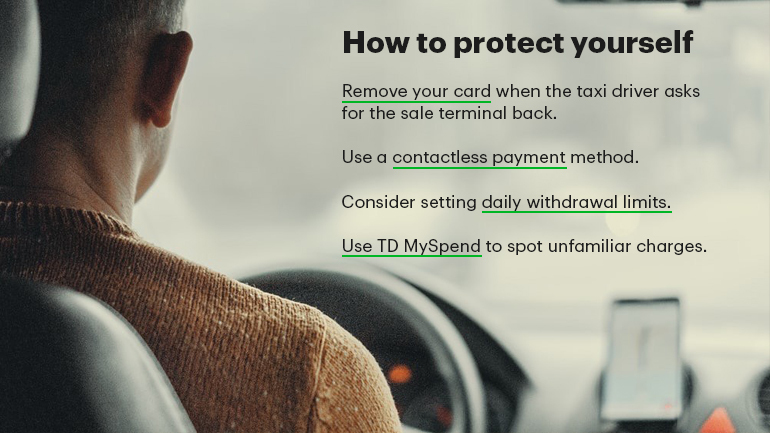

How to protect yourself

- Don't make payments for people you don't know.

- Keep an eye on your payment card at all times. In any situation, if a merchant asks for the POS terminal back during a transaction, remove your card first.

- Whenever you can, use contactless payment options, such as tap to pay. No PIN is required for contactless payments.

- Make sure to get a receipt for any payment card transactions.

- Consider setting daily withdrawal limits – that way even if your debit card and PIN are stolen, there is a limit to how much can be withdrawn from your account each day.

- TD customers can also use TD MySpend, a service within the TD app, which provides real-time notifications of spend transactions and helps make it easier to spot suspicious or unfamiliar charges.

Most Canadian financial institutions offer protection against certain types of fraud if the customer has met their security responsibilities – through proactive measures such as protecting their PIN, not storing passwords on personal devices, and not lending their credit or debit cards to other people.

What should you do if you think you've been the victim of the taxi fraud scam?

Report it - If you believe you've been a victim of the taxi fraud scam or any other type of financial fraud, the RCMP recommends you contact your financial institution immediately, report the incident to your local police and file a report with the Canadian Anti-Fraud Centre.

Learn more and help others - The Government of Canada Competition Bureau's "The Little Black Book of Scams" is a free download that can help you learn more about some of the most prevalent scams currently employed across Canada.

Talk about it – While you may feel embarrassed, you are definitely not the first person who's been tricked by this type of scam. Sharing your story can help others avoid being scammed.