Are you an impulsive spender or more of an avid saver? Do you often trade stocks based on market conditions, or are you invested for a longer term? Whether you know it or not, behind each financial decision we make are unconscious factors driving them without us being aware of their effect. The study of these psychological factors and how they influence our financial decisions is called behavioural finance.

According to the first annual TD Wealth Behavioural Finance Industry Report, there are stark differences in how Canadians spend and invest their money based on factors such as age, gender and even relationship status. This is especially true when comparing the financial habits of Millennials and Baby Boomers.

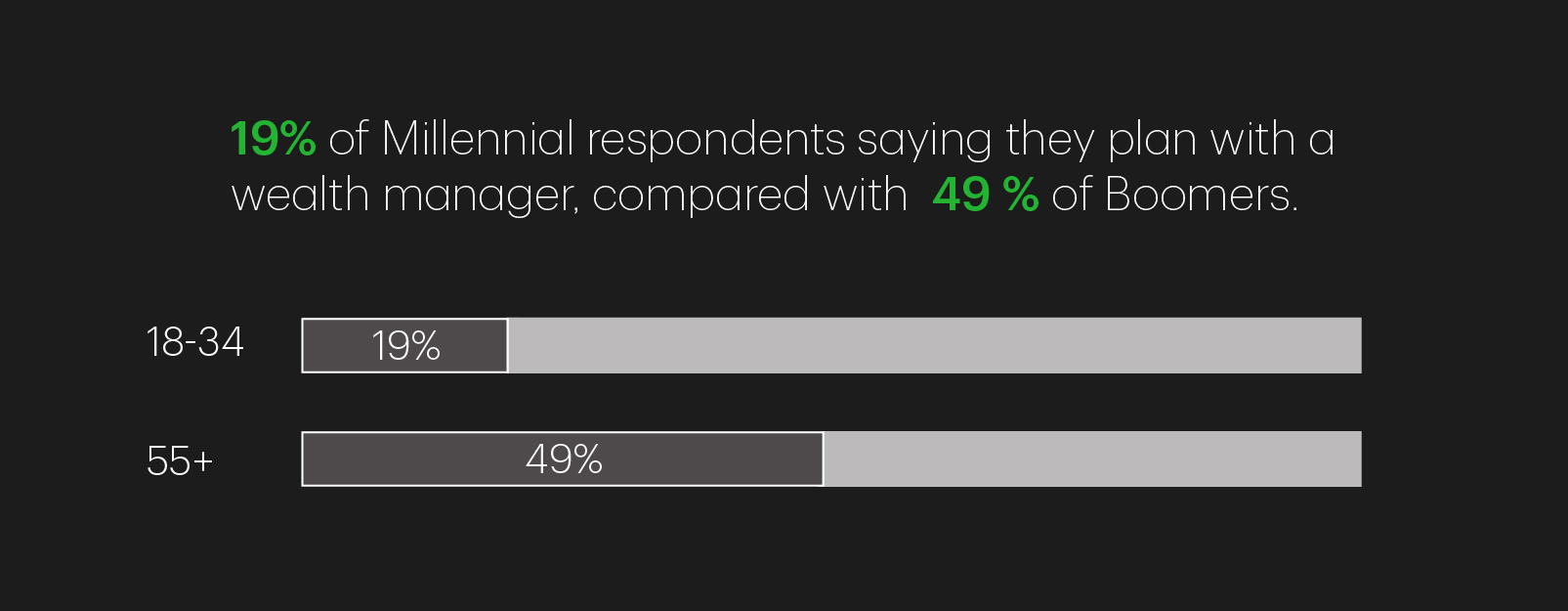

For example, the report found that 53% of Millennials (aged 18-34) say they are 'quick to react' in situations like market volatility or sell offs, compared with only 27% of Baby Boomers (aged 55+). Millennials are also more likely to question the investment advice they receive: 57% of Millennials surveyed* in the report say they question the advice they receive, compared with 38% of Boomers. According to the data, Millennials are also planning investments with wealth managers much less often, with 19% of Millennial respondents saying they plan with a wealth manager, compared with 49% of Boomers.

While we often don’t think about the underlying motivations that prompt us to make financial decisions (Should I buy this? Save for that? Do I have enough to retire?), the study sheds some light on what's behind the financial choices we make to better understand our tendencies. Knowing more about these could help us identify potential patterns (and maybe help us avoid money lessons learned the hard way just as these wealth advisors share).

To learn more about behavioural finance and some of the underlying factors that may be impacting your own financial decisions, read the report here.

*In 2017, TD Wealth conducted an online quantitative study with the aim of collecting market data to better understand the financial behaviours of affluent Canadians. Maru Group Canada fielded the English and French online study and provided the research panels of consumers with geographic distribution across Canada.