After two years of the COVID-19 pandemic, Canadians are once again in an atypical retirement savings season. And a recent TD survey shows that many Canadian respondents are rethinking their savings strategy ahead of the annual RRSP contribution deadline on March 1.

According to a recent Ipsos poll conducted on behalf of TD, nearly two-thirds (59%) of Canadian respondents say they’ve adjusted their savings goals in the last year - up almost double from 35% last year.

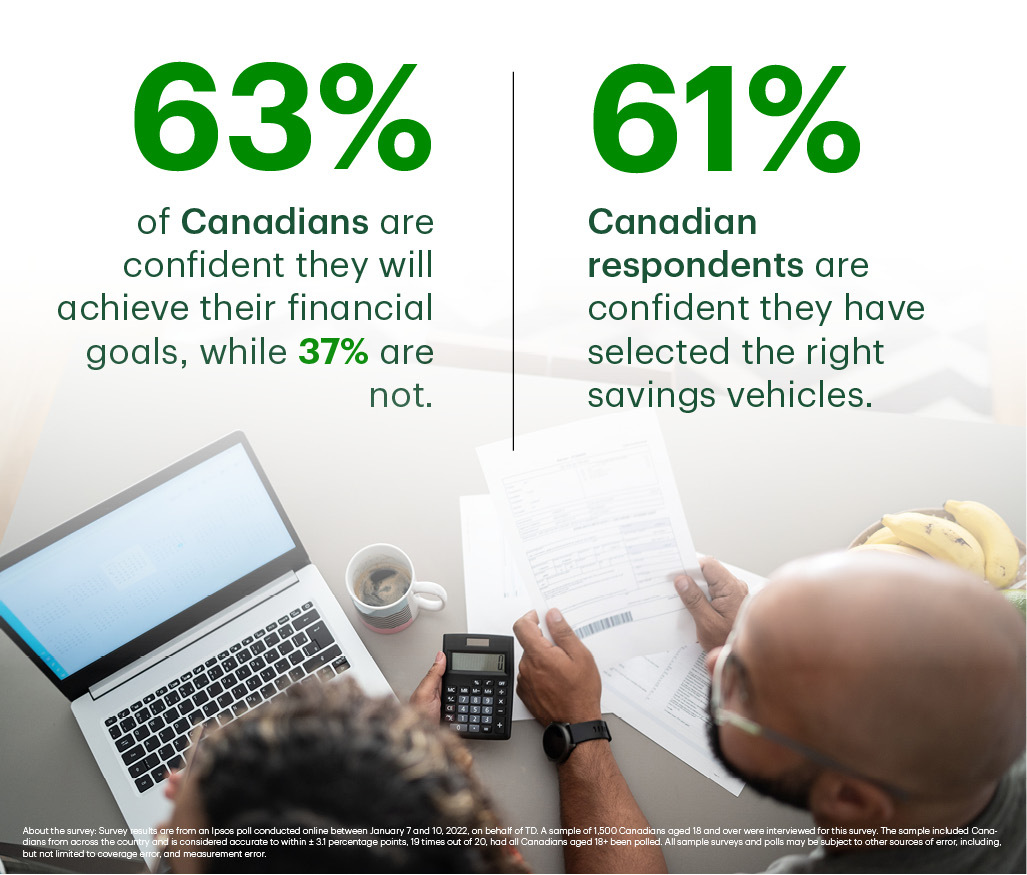

Moreover, nearly four in 10 Canadian survey respondents (37%) said they aren't confident they'll achieve their financial goals.

Whether you describe your financial confidence level as half empty or half full, the start of a new year is often a good time to review your progress, assess your financial goals and update them as needed.

"I tell my clients, you go to the dentist twice a year, you go to the doctor once or twice a year; setting financial goals and checking in on your finances should also be part of your regular routine," says Jonathan Crotty, a TD advisor in Halifax, N.S.

Below, Crotty provides some insights about how to set financial goals, should you have a TFSA an RRSP or both, and how to feel more confident about investing.

How can Canadians start setting financial goals?

"A lot of my customers don’t have a budget, or they think they do, but I generally find that they aren’t using realistic numbers. A lot of it comes down to self-reflection, and regularly reviewing their finances. Some folks I speak to say, 'I don’t really have a financial goal.' Deep down, people do have goals for themselves, they just don’t realize it. Most customers I've met want to save more money, or be able to take a big trip, buy a new car, or retire early. It's also about taking responsibility over creating a sound budget and speaking to a financial advisor at least semi-regularly.

"I like to ask my clients open-ended questions like, 'What is most important to you?' If you tell me 'I want to buy a house,' great! When? How much money do you think you'll need? Do you know what you need to buy a house? Then we can start working together to try and bridge the gaps to achieving your goal in the timeline you wish to achieve it.

"If you've identified retirement as one of your goals, have you thought about how much you're going to need in retirement? What kind of lifestyle are you going to want when you retire? Are you someone who would want to continue working? Do you think you will want to travel? People should be asking themselves those deeper questions.

"If you’re looking to get a better idea of what kind of savings you might need to retire with your desired income, The TD Retirement Calculator can be a handy tool. You can access that tool here."

When savings goals get knocked off course, what can customers do to reevaluate their financial situation towards getting back on track?

"Budgeting or 're-budgeting' in this case, is key. The last two years have taught us to expect the unexpected. I always speak to my clients about having an emergency fund in place, on top of the money you're putting away for your goals. If an emergency does arise, you don't want to be asking yourself, 'How am I going to survive this?' You'd likely much prefer to be asking yourself 'What do I need to adjust in my budget to survive this?' Usually, the general guideline is that an average person should have between three to six months' worth of their monthly budget expenses saved in an accessible bank account, so it's there on an as-need basis.

"On the flip-side, your budget could also change in a good way. Let's say a customer pays off their student loans, and now has an extra $300 a month that was previously going towards paying down debt. We want clients to find ways to put that extra money away for their goals, so they’re not just now spending that $300 on frivolous things. Whether it's a positive or negative shift in your budget, it's always about re-budgeting, reevaluating, and making it work for your lifestyle."

Should you choose between an RRSP and a TFSA? Should you have both?

"Assuming, they're employed, and have regular income coming in, I typically recommend that my clients have both a TFSA and an RRSP. Both are great options. RRSPs are generally designed for saving for retirement, and provide a tax deduction so that the amount you contribute lowers your taxable income. Your money can grow tax-deferred within the RRSP, but you pay taxes when you withdraw money from the account. TSFAs on the other hand allow you to grow your money tax-free within the account, which means you aren't taxed on interest earned, dividends or capital gains. You can also withdraw funds from your TFSA tax-free."

How often should people review their investments and savings plans?

"Generally, I tell my clients we should meet any time there are changes to their personal or financial circumstances. Things like a job loss, promotion, or an expanding family. Any major life change is a good time to revisit your finances to make sure you're still on track. If a person doesn't go through any major life changes in a year, they should still check over their finances at minimum once in that year. It's always important to do an annual financial health check. Speaking to a financial advisor should never feel intimidating. We’re here to help educate our clients, so they can feel confident about their investments. For people who want to do their own research, tools on the TD website. I always send my clients the link to the TD Ready to Invest portal, because there's some helpful resources on there."

About the survey

Survey results are from an Ipsos poll conducted online between January 7 and 10, 2022, on behalf of TD. A sample of 1,500 Canadians aged 18 and over were interviewed for this survey. The sample included Canadians from across the country and is considered accurate to within ± 3.1 percentage points, 19 times out of 20, had all Canadians aged 18+ been polled. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.