On Tuesday, TD Economics published its latest report, entitled "Questions? We've got answers: Addressing issues impacting the economic and financial outlook." The report addresses current issues related to the economic outlook, starting with the global outlook and the economic implications of the health crisis moving from a pandemic to an endemic phase among advanced countries. This is followed by a discussion of "peak economic growth" and the consequences of governments unwinding the fiscal support measures taken over the past year and a half. This is followed by issues related to the labour market, the housing outlook, inflation, and monetary policy. Below is a selection of questions from the report. To read the full report click here.

How is the global outlook evolving?

The global economy is bouncing back, but 2021 is shaping up to be a two-track recovery. On one side, advanced economies (AEs) with robust healthcare systems and substantial fiscal power have used their resources to deploy aggressive mass vaccination schemes and social supports. On the other side, emerging and developing markets (EMs) have struggled to acquire vaccines and contain the virus, resulting in exponential spread and depleted resources to treat the health and economic symptoms.

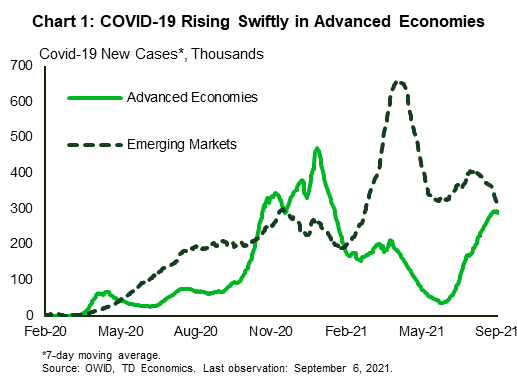

New COVID-19 variants continue to form the largest risk factor in the forecast (Chart 1). In AEs with high rates of vaccination, vaccine passports (or health certificates) are becoming increasingly commonplace, reducing the need for large-scale shutdowns when cases pick up. We have seen versions of this applied in Israel, France, Italy, and regions within Canada and the United States. Even with these adjustments, rising caseloads threaten to prolong labour shortages, weaken consumer confidence, and reduce business capacity, thereby slowing the recovery.

Fiscal spending in AEs is likely to remain elevated and income supports to extend as long as the health crisis continues to weigh on activity. In Europe, NextGen E.U. funds should help support growth in the second half of 2021 and into 2022. Meanwhile, the fiscal impulse from the pending U.S. infrastructure bill should provide a lift to the global economy.

China led the way out of the recession in 2020, but its outlook is now muddied. Authorities are committed to stamping out any local transmission of the virus, and this is interrupting shipping and transportation linkages. These types of strict public health interventions have the dual effect of depressing global demand while maintaining the supply chain disruptions that have become synonymous with this recovery.

The outlook for 2021 continues to be heavily virus dependent. Despite rising infections, abundant vaccine supplies and ongoing fiscal stimulus in advanced economies leave this outlook relatively unchanged from our previous forecast. At the same time, a dearth of vaccines and difficulties in managing viral transmission add more downside risk to the recovery in emerging and developing markets.

What are the economic implications of moving from a pandemic to an endemic phase?

At this juncture, the endemic phase applies only to those countries that have benefited from high vaccine access, and it will be multi-staged. This is just the first inning. Economic growth is anticipated to persist but remain restrained relative to the counterfactual environment that would lack supply disruptions and trial-and-error tactics to measure health outcomes against the pandemic phase.

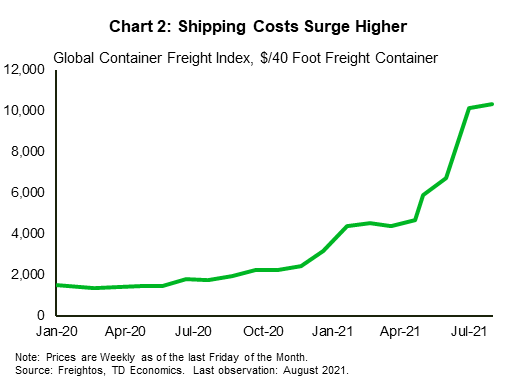

In the short term, global supply chains will remain pressured. Manufacturers in Europe and the U.K. have already reported shortages of raw materials as key reasons for being unable to meet production targets. Meanwhile, limited vaccine supplies in many emerging markets mean strict public health measures can be imposed to limit strain on hospital resources. We had previously suggested that supply disruptions could persist for a year once economies re-open, and there's no reason to think otherwise at this stage.

A transition away from strict lockdowns to less stringent interventions is allowing for broader economic activity. But, labor supply may continue to reflect the tension of lingering hesitancy on the part of workers, as officials transition to accommodating a degree of viral spread in the post-vaccine environment. At the same time, workplaces will need to navigate their responses to outbreaks, while any outbreaks that lead to periodic classroom closures would also impact parents.

Using the UK experience as guidance, these challenges can manifest in frequent disruptions and price spikes for certain goods (food items, for example) and challenge businesses in ensuring adequate staffing levels and health-safety requirements.

The rebalancing of demand from goods back to services is occurring and will be a critical piece to easing the pressure on supply chains and allowing manufacturers to clear backlogs (and restore depleted inventories). So far, strong demand for goods and raw materials has limited the logistics industry’s ability to address stranded containers and port traffic. Global container prices surged 50% month-over-month through July due to a lack of available units (Chart 2).

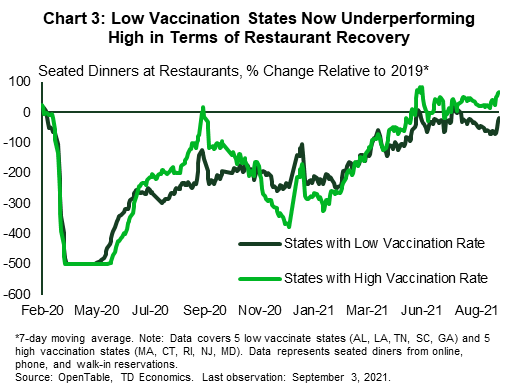

Even without formal restrictions, the rise in Delta-variant cases is likely to weigh on consumer confidence and slow the rebound in spending. We are seeing signs of caution in the high-frequency data for restaurant reservations, credit card spending and reports from airlines of slower bookings and increased cancellations (Chart 3). The early-endemic phase also means certain sectors are unlikely to return to anything resembling their pre-pandemic level. Conferences/conventions, large entertainment venues, business travel and tourism are likely to bear the markings of the infamous "L-shaped" recovery, as countries navigate infection levels and vaccine requirements.

Importantly, the endemic phase means different things to different countries. However, a common thread is apparent: vaccine requirements are preferred to the re-imposition of business restrictions. The wave of infections and hospitalizations within the U.S. leaves regions with low vaccination rates at risk of re-imposing restrictions to protect the health care sector. Louisiana is among those noting this threat. However, others are taking a defensive tactic, such as Chicago's "orange list" of states that requires unvaccinated travelers to obtain a COVID-19 test in advance of arrival or quarantine for 10 days. More meaningful has been a surge of major industry players announcing workforce vaccine requirements, from the Federal government to airlines to banks to food processors to entertainment firms.

In contrast, other regions are applying a national strategy, such as the UK, France, Italy and Israel, by imposing domestic "vaccine passports" for access to high risk, indoor and group activities. National strategies have the advantage of greater transparency and consistency for businesses and households, but may also limit economic activity within regions that are experiencing lower infection risks.

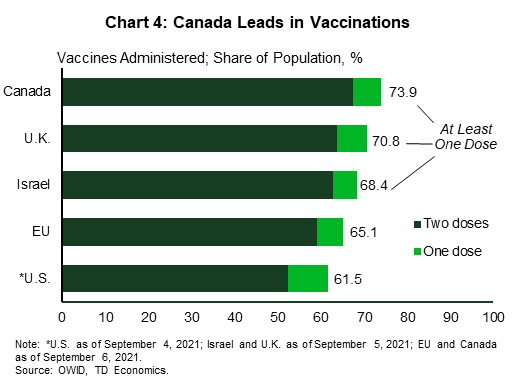

Canada's vaccine rate is near the top of international rankings (Chart 4), but are still not high enough to put the virus fully in the rearview mirror. Alberta's attempt to lift nearly all mitigation measures by mid-August was postponed due to rising cases and health considerations. Other regions are imposing changes to allow for more sustainable outcomes, such as vaccine passports in Quebec. However, past infection waves have shown that Canada tolerates much lower hospitalization thresholds relative to other countries. This makes the country vulnerable to the possibility of more restrictive measures, even if case counts accelerate to a lesser extent than others. This may have been the catalyst for the federal government to follow the U.S. lead by announcing workforce vaccine requirements despite higher vaccination rates.

How is the American job market recovery unfolding?

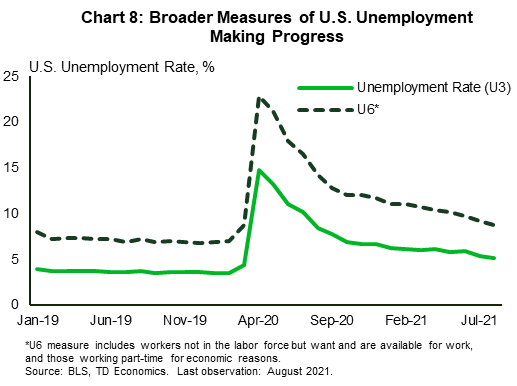

Job growth slowed in August, but the U.S. has made solid progress on the job front. The unemployment rate has fallen from 6.1% in April to 5.2% in August. While that headline figure still understates the extent of joblessness, broader measures of unemployment have made an even larger improvement than headline unemployment – like the U-6, which includes marginally attached workers plus those working part-time for economic reasons (Chart 8).

The stagnating recovery in labor force participation has been a key disappointment. The participation for core aged workers (25-54 years) has started to make some progress, but the total measure has gained less ground due to older workers (55+ years). Indeed, the U.S. has lost about a million workers over the age of 65 since COVID-19. These workers are less likely to return to the workforce, and this shift alone reduces the participation rate by 0.4%-points. This is a key reason why we are unlikely to see labor force participation re-attain its pre-pandemic peak.

The improved hiring pace and unemployment rate decline exhibited at the national level are reflected across most states within the country. The East Coast region continues to lag the rest of the country due to a softer showing in the Northeast. The southern half of the region, meanwhile, is faring better.

The recovery of the labor force participation rate across East Coast states has been a mixed bag over the last several months, with only half of all states in the region recording an improvement in this metric relative to the start of the year. Demographic headwinds pose an added challenge for Northeast states, but above-average vaccination rates are offering a tailwind in the near-to-medium term.

How does Canada's job market recovery compare?

After a brief decline due to the third wave, Canada's labour market moved back into the 'plus' column in June and July. Over these two months, a total of 325k positions were gained, the labour force expanded by nearly 200k workers, and the unemployment rate fell to 7.5% – the lowest it has been since the start of the pandemic.

The recent improvement was due to the services-producing sector. Hiring in high-touch services was especially strong, as this area of the economy accounted for 52% of the total number of jobs added in June and July. The same cannot be said for the goods-producing sector, which saw nearly 50k net positions lost. This sector's woes are attributable to a drop off in employment in the construction industry, which coincides with the cooling Canadian housing market.

Despite robust advances over the past few months, labour market conditions have not returned to pre-pandemic norms. As of July, employment was 1.3% below the February 2020 level, hours worked were 2.7% below, and long-term unemployment was still 150%, or 250k people, higher than historical standards.

By province, B.C. is the only province to have employment above its pre-pandemic level. In most other regions, employment is still 1% to 2% below where it was prior to the pandemic. Notably, Saskatchewan and PEI are 3.5% off the mark.

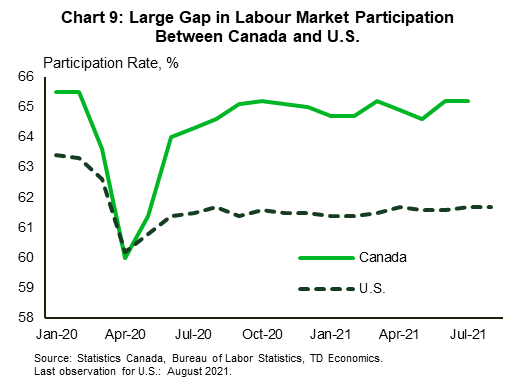

Even with these shortcomings, Canada's labour market recovery is ahead of the U.S. Employment in the U.S. is 3.8% below its February 2020 level compared to 1.3% in Canada. The official unemployment rate may be lower at 5.4% in the U.S., but in addition to methodological differences, this is due mainly to a drop in labour force participation through the pandemic. In Canada, the labour force participation rate is only a touch below pre-pandemic rates (Chart 9). Helpful government policies, better handling of COVID-19, and higher vaccination rates likely contributed to the outperformance north of the border.

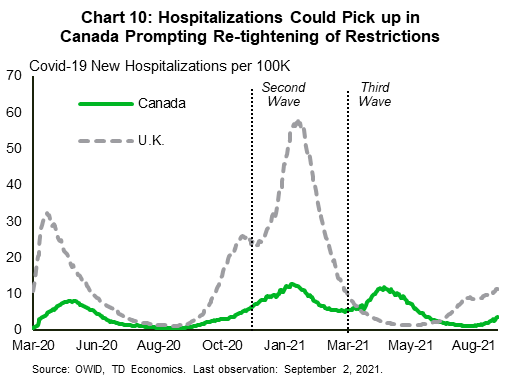

As we look ahead to the rest of the year, there are some downside risks to the Canadian labour market recovery. Nearly all provinces have seen an uptick in COVID-19 cases recently, although hospitalization rates remain low (Chart 10). A localized outbreak has already prompted the B.C. government to re-impose some restrictions in early-August, and more stringent measures could follow if hospitalizations rise as they had during the second and third waves. Elsewhere, Alberta and Ontario have paused their re-opening plans due to the rise in cases.

The U.K.'s recent surge in Delta variant cases offers a cautionary tale to Canada. Its hospitalization rate, while well below what the country faced previously, is close to the peaks seen in Canada this year. With provinces further relaxing public health guidelines, and schools reopening, Canada could see a pickup in the number of people admitted to hospitals, which could prompt a revisiting of strategies.

What's next for North American housing markets?

Following a strong run in the second half of 2020, U.S. existing home sales have slowed this year. By mid-year, sales appear to have found some footing just below the six million (annualized) mark.

With inventories of existing homes for sale remaining exceptionally low at a little over a million units, strong competition from buyers has continued to drive price growth. According to CoreLogic data, more states joined in on this trend as the second quarter unfolded.

Home price growth across the East Coast region exhibits a similar pattern, with the rate of change accelerating across most states. The main outliers to this theme are New Hampshire, where strong momentum earlier in the year has given way to some recent moderation, and New York state, where home price growth continues to move mostly sideways near the 3% (annualized) mark.

Housing demand is likely to remain well supported over the medium term as the U.S. labor market healing continues and more jobs are recouped. The fact that mortgage rates have once again reversed course to their lowest level on record offers an added tailwind in the near term. With time, the arrival of additional new inventory (as signaled by a healthy pace of housing starts over the last several months) should help lead to a more balanced U.S. market.

Since hitting the absolute peak of the mountain in March, Canadian home sales have now fallen 28% through July. Although sales are falling at a rapid pace, they likely have further room to normalize. Accordingly, further near-term declines could be in store before activity stabilizes in 2022

This captures a "soft-landing" scenario (where sales eventually settle at lower, but at still-healthy levels). Stronger job markets, low interest rates, faster population growth, and high household savings (which can be funneled into down payments) form a healthy backdrop for housing demand.

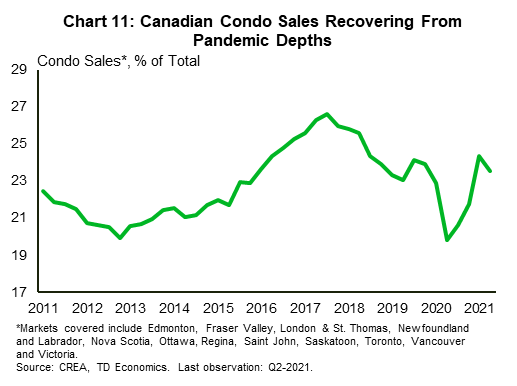

Canadian home price growth has cooled, but this is partly a function of the compositional shifts in sales. Between March and July, Canadian average home prices dropped 5%, reflecting declines in Alberta, Ontario, Saskatchewan, New Brunswick and PEI alongside modest growth in most other Provinces. Softer demand has weighed alongside tough affordability conditions in several markets (exacerbated by the tightening of stress test rules in June). Buyers are moving down the value spectrum to lower priced units within the condo market.

Because average home prices in Canada can be heavily impacted by transactions at either end of the price spectrum (i.e., "compositional effects"), what is being sold matters. In this regard, sales of less-expensive units have outperformed, downwardly pressuring the average home price metric. Note that benchmark prices (which control for compositional effects) increased, on average, from April to June, in contrast to the drop in average prices. In addition, sales of condos have consumed a rising share of the overall market (Chart 11), as their affordability vis-à-vis other structure types has dramatically improved, and investor demand has risen.

Moving forward, home prices across Canada should continue growing at a more moderate pace – marking a notable change from earlier in the pandemic. The combination of cooler demand, more balanced market conditions and compositional forces should weigh on price growth. On this latter point, re-openings and a return-to-office should improve the attractiveness of urban centers, supporting a rising share of condo sales.