It wasn't that long ago that the process of buying a home was a fairly similar experience for most consumers.

It usually went something like this: You gathered all your documents to fill out a mortgage application at the bank, you were told how much mortgage you were approved for, and then you went out to find the home of your dreams.

There was very little deviation – regardless of where you lived or the type of home you were looking to buy.

Technology has changed all that. Consumers now have access to more digital tools than ever before, enabling them to do everything from browsing open houses and recently listed properties online, to shopping around for mortgage options from their smartphone.

"Our customers have different needs when it comes to home ownership, but for the majority their path begins by going online – with many wanting the option to start their mortgage process there as well," said Derek Askew, Senior Manager, Real Estate Secured Lending at TD.

Increasingly, consumers are looking to financial institutions for technologies that empower more personalized and convenient solutions. And this has prompted organizations like TD to expand their digital toolboxes, offering new services and tools that allow customers to bank and transact on their terms.

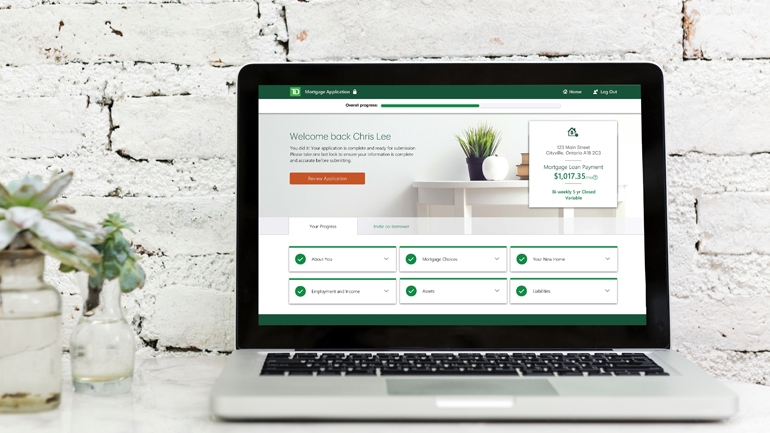

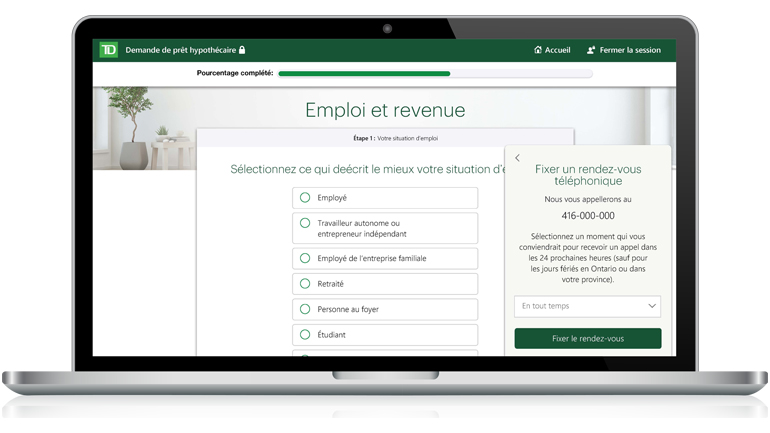

This week, TD introduced a leading digital mortgage application. The digital application makes it simple and convenient for consumers who want to take control of the application process and apply for a mortgage when and where they want. The new digital mortgage application is available on all devices, with features such as 24/7 access, save and resume, status tracking, and document upload.

For consumers needing additional support, TD has a group of dedicated Mortgage Specialists readily available to assist throughout the digital application so that help is always available throughout the process.

The tool is the latest addition to TD's expanding in-person and digital mortgage tools, including the TD digital mortgage pre-approval and a digital mortgage affordability calculator, all of which have been designed to make the process of finding and buying a home easier and more convenient for customers.

This latest offering means that customers who are eligible, can now perform the entire mortgage application process digitally. And for those who prefer the face-to-face approach, TD also offers more than 1,100 branches and 1,080 mobile mortgage specialists across Canada.

"It's all about choice. We know that customers want the ability to choose the homebuying process that's right for them and feel confident along the way in whatever channel they select," Askew says.

For more information on the TD Homeowners' Journey, please click here.