By Beata Caranci

SVP & Chief Economist

In 2013, TD Economics published a report titled Get on Board Corporate Canada, that called out the lack of progress of women on the boards of publicly traded Canadian companies and recommended the adoption of a "comply or explain" (C/E) board disclosure policy. This was grounded in findings that showed that Canada was falling behind global peers, as women’s progress within the labour market and increased levels of education hadn't yet translated into a greater share of board representation.

Canada: no longer the turtle in the race

TD Economics recommended the adoption of the C/E board disclosure policy to mobilize shareholder market forces by creating accountability, transparency and measurability of board selection and diversity practices. The Ontario Securities Commission (OSC) held the same opinion, and the C/E disclosure policy subsequently came into effect in 2015.

Under the policy, most companies listed on the S&P/TSX are required to state whether they have a policy or a target for the representation of women on their board. Additionally, it asks these organizations to disclose how many women are on their board and executive officer positions. Choosing to do neither requires an explanation.

TD Economics has now conducted a review of the effectiveness of the C/E policy since its introduction in a recently released report entitled, Corporate Canada Is Getting On Board.

Progress since 2015

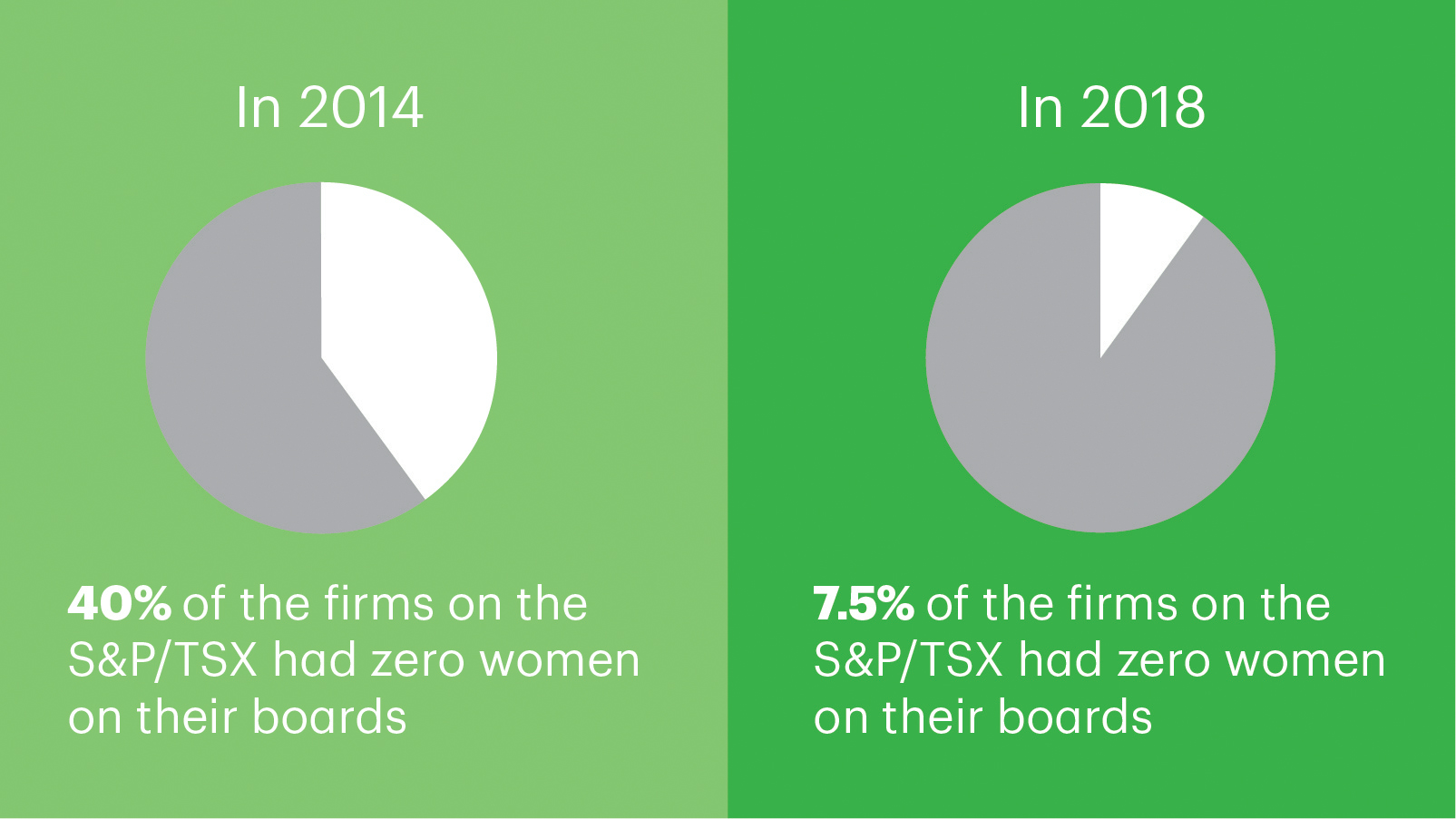

- In 2014, 40% of firms on the S&P/TSX had zero women on their boards, but by 2018, this number dropped to less than 10%, which is a positive sign.

- Internationally, Canada has stabilized its place in the rankings for female board representation. When the first TD Economics report was released several years ago, the international benchmark ranked Canada higher than it does today, even though the representation was far lower than it is today (13% with 2011 data, compared to 27% in 2018). This is because just as Canada is making progress, so too are other countries with the aid of gender diversity policies.

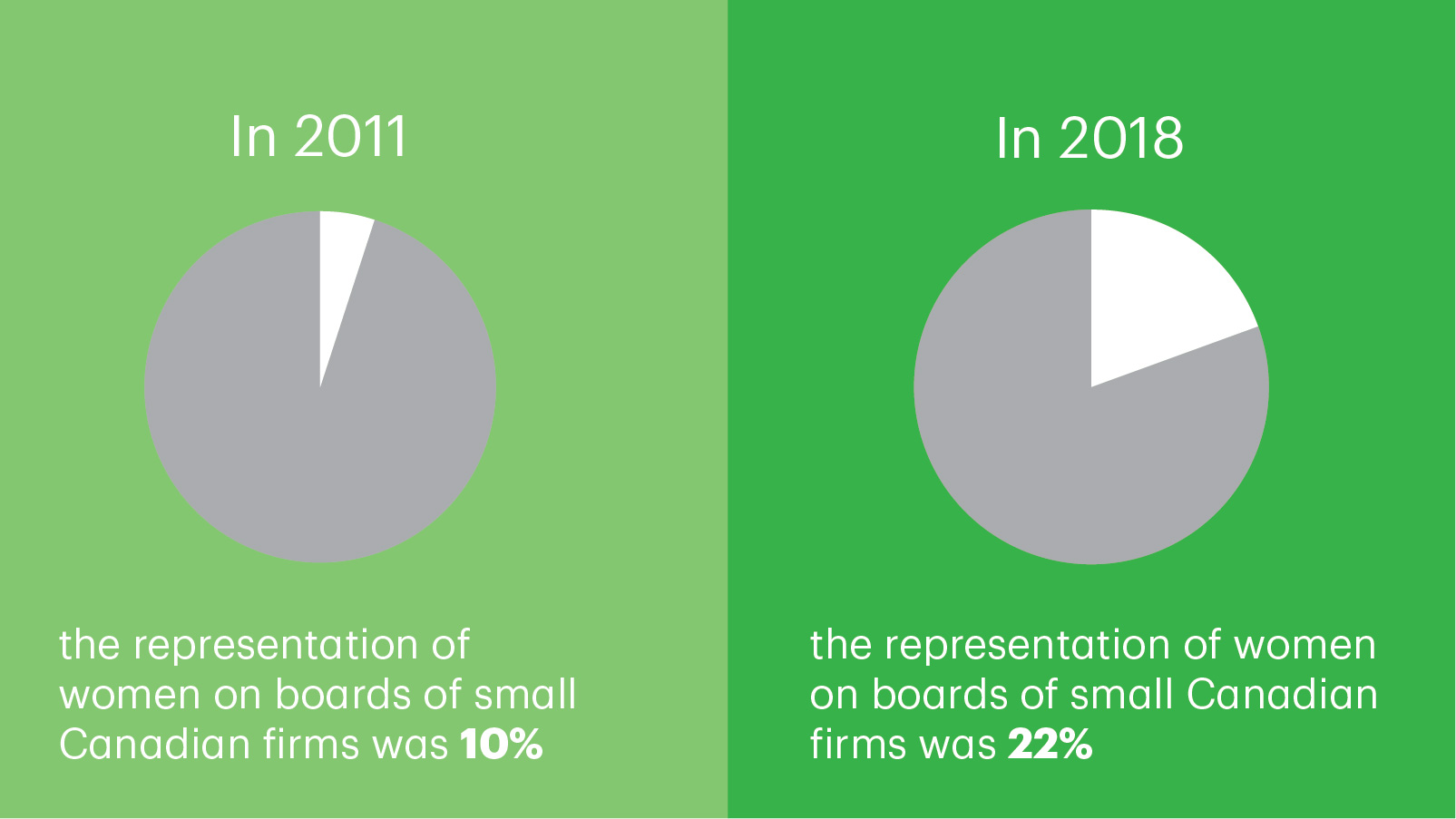

- Canada's S&P/TSX female board representation went from lagging the U.S. S&P500 index on every metric back in our 2013 report. The table has completely turned since the C/E policy came into effect. Canada now outperforms the U.S. in seven of ten industries, and the speed of adjustment among smaller sized firms has also been faster north of the border.

In the grand scheme of incentive structures, market-driven C/E policy is characterized as the carrot rather than a stick approach (quotas). Comparing across countries, C/E disclosure policies appear as effective at increasing women on boards as quotas, with the passage of time. The policy gives shareholders the tools needed to meaningfully reflect on and hold firms accountable to gender diversity. In doing so, it also avoids a one-size-fits-all approach and mitigates downside risks related to non-market solutions.

Still more work clearly needs to be done, particularly among smaller sized firms where there's a higher prevalence of falling short of the important 30 per cent threshold. This is where the minority-voice gains a reasonable level of critical mass. Contributions cease being representative of the group and begin to be judged on their own merit. Nonetheless, initial results after this policy were implemented are encouraging.

The follow-up report from TD Economics offers a few recommendations to support increased female board membership in the future, including:

- Small firms are key to continued progress. These firms represent 63 per cent of board seats. If all of Canada's small-sized firms were to hit a tipping point of three women on their boards, this would single-handedly move the entire S&P/TSX up by 10 percentage points to 34 per cent.

- Companies must watch for twokenism. Organizations must continue to focus on broadening their searches to realize the benefits of diversity and ensure equitable candidate selection. For continued improvement in female board representation, it's imperative decision makers do not strive to simply "hit the number" versus instituting more meaningful and sustainable change to how they approach board member selection.

- The pipeline of talent is key. To continue to drive more women into the ranks of Board membership, there needs to be continued focus on improving the representation of women in senior executive ranks. Looking at Canada, Australia and the UK, there is still work to be done to drive progress in the executive ranks, despite significant progress made at the board level.