Innovation may be the buzz word of the decade, but there's a good reason you hear the term daily. Consumer behaviors that were already changing, which were only accelerated by the pandemic, lead to customers seeking omni-channel and digital experiences. Simply put, customers want a seamless, effortless experience when connecting with businesses.

And as consumers continue to ask for these experiences, brands like TD are responding by leveraging augmented and virtual reality technology to interact with them in new, more expansive ways.

Watch the video below to learn more.

Before TD's Head of Innovation and Emerging Platforms Mohamed Abbas started his role in 2022, he knew when he joined the U.S. Digital team in 2018 that AR/VR would be an important next step in providing new, meaningful interactions for the bank's growing digital customer base.

"In 2019, our team began experimenting with VR by piloting a digital welcome kit for new customers," said Abbas. "Our goal was to use VR as a tool to educate customers on the services available to them on the TD Mobile app and Online Banking through interactive gameplay."

The kit included a VR headset compatible with a customer's smart phone and a QR code. When scanned, customers were presented with point and shoot games that taught them digital banking features such as mobile deposit, send and receive money, online bill pay and more. After completing the game, customers proceeded to a training video explaining the self-serve function.

What is Augmented Reality?

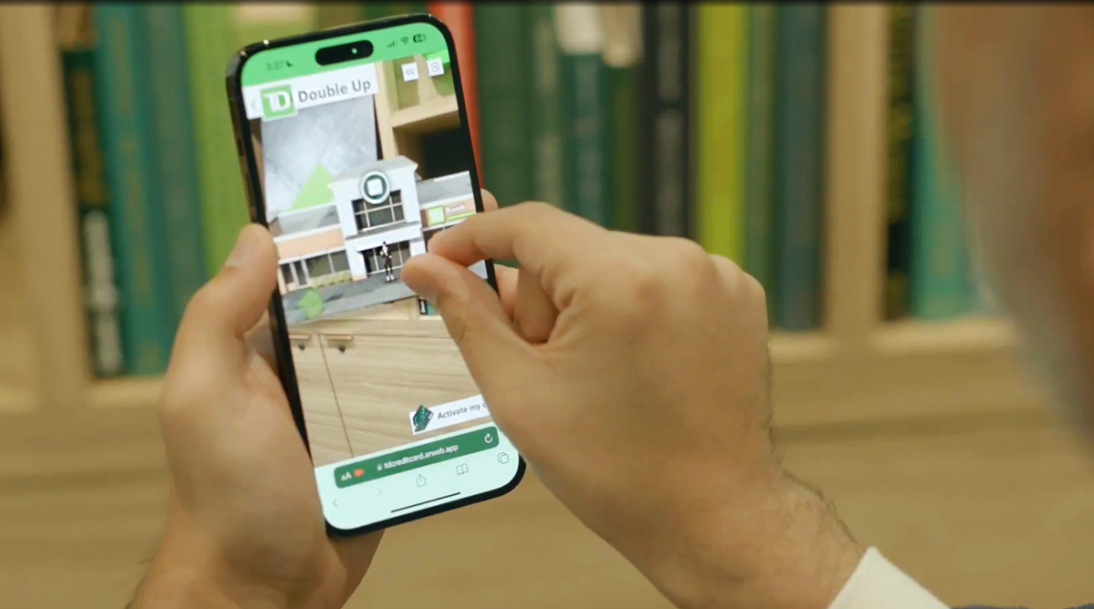

Now, Abbas is spearheading TD's efforts to interact with customers through AR, or augmented reality, a technology that uses the real-world environment and superimposes information or images through a user's smartphone or tablet (think Pokémon Go and Snapchat).

Outside of entertainment, Abbas says there are also practical uses for AR that can be employed to provide financial literacy and education for customers. His team explored those scenarios at a recent hackathon event they hosted at TD Workshop in Philadelphia's University City district.

"We assigned use cases to colleagues from various lines of business, with a focus on product, design and technology, and asked them to create an AR experience to help educate customers on products such as first-time homebuying and debit card benefits," said Abbas. "It was inspirational to see everyone's creativity come to life, and it's clear that AR/VR has untapped potential when it comes to financial literacy."

As customers turn to digital for their banking needs at an increasing rate, AR/VR will become an important part of TD's plans.

"Today, most of our competitors are digitally active, and we expect that to continue," said Levi Sutter, TD's Head of U.S. Digital Platforms. "We are continuously growing our digital offerings to meet the needs of our customers in a time and place of their choice, and we look forward to exploring AR/VR as a servicing channel and a resource for educating customers on TD's digital capabilities."

And while digital adoption is on the rise, Sutter explains that there are also potential use cases to use this technology in TD's physical store network.

"When we think about the physical store, we want to take the opportunity to interact with that customer who may wait in line to deposit a check at an ATM or with a teller, and use AR/VR to inform them of our mobile check deposit feature, for example," said Sutter. "At the end of the day, it's about giving our customers options to bank with us across multiple channels and at their convenience."

Outside of the U.S. Digital team's focus to be a leader in the AR/VR space in banking, they're also passionate about engaging the community to cultivate the next generation of technology professionals. TD Workshop recently sponsored and hosted an event with Coded by Kids, a nonprofit fighting inequity by preparing underrepresented young people to succeed as tech and innovation leaders through project-based learning and mentorship. The team is hoping to collaborate with similar organizations in 2023 to inspire individuals at various age groups and backgrounds.