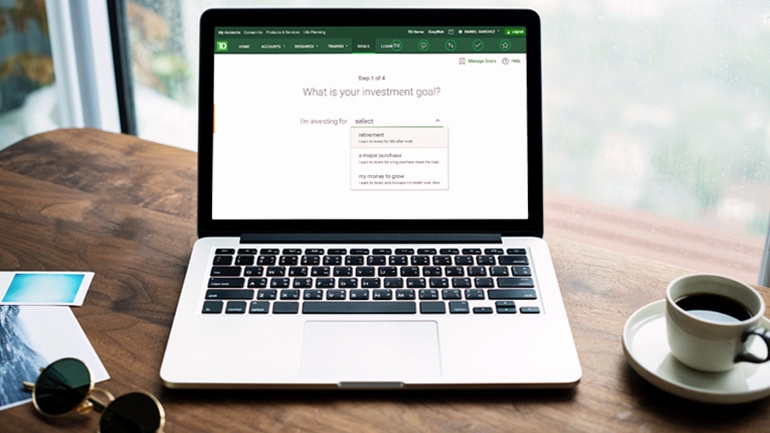

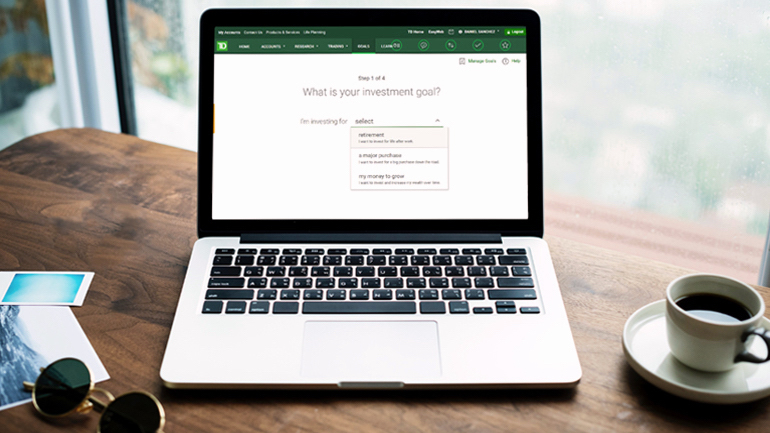

There are plenty of do-it-yourself investing platforms on the market, but the reality is that the average user often lacks the necessary help to set, track and achieve their financial goals. With the launch of the new Goal Planning feature from TD Direct Investing – a free, online, interactive financial planning tool that's the first of its kind in the Canadian investing industry – TD is looking to give its customers the ability to take a goals-based approach to investing.

Paul Clark, President, Direct Investing and EVP, TD Bank Group, has seen the investment industry undergo rapid changes as technologies advance and consumer demand has shifted - we asked him a few questions to help us understand a bit more about the Goal Planning tool and the strategy behind it.

Why was it important for TD to create a goals-based DIY investing tool?

Paul Clark: At TD, we are always looking for feedback from our clients to help make our products and services better, enabling us to help our customers become more confident when managing finances and planning for the future. What we have learned is that even though there are a lot of do-it-yourself investing tools out there, generally, people aren’t taking advantage of them.

To combat this, we invested in an innovative technology platform to create a savings and investing tool that was simple and inexpensive to use, but also sophisticated enough to evolve with a client’s financial needs over time.

What makes GoalAssist unique?

PC: The mindset employed by other do-it-yourself investing tools is what we would classify as "set it and forget it." Which is fine for clients looking for a basic, long-term investing solution. But it also assumes everyone is investing for the same reason. Today, there is no single demographic that defines the online investor, and we have found that many of our clients are looking for a tool that will not only help them create a customized financial plan, but actively assist them in achieving their long and short-term financial goals. Which is what makes the Goal Planning tool unique: its goals-based approach to investing. Goal Planning functions within WebBroker, and it allows clients the flexibility to plan for a vacation or new car, or something longer term, such as university tuition or retirement.

How does a goals-based approach work?

PC: Goals-based investing is designed to help you gain the financial confidence necessary to achieve specific financial goals. In the tool, users answer a series of questions about their income, risk tolerance, and ideal timeline, and the Goal Planning tool enables them to create a portfolio. Depending on the user’s level of knowledge and risk tolerance, the system will periodically ask them questions and prompt them to help keep them on track and can also send status alerts when attributes of their portfolio change, due to fluctuations in the market. What makes this so compelling for investors is that the tool is free, easily accessible and flexible enough to suit any level of investment income.

Where can clients learn more about investing?

PC: Financial education is key for customers looking to become confident about their money and to take control of their financial future. TD Direct Investing features one of the largest investor education libraries in the country, including a suite of on-demand videos, live, online Master Class workshops, webinars and reports. All of which are free. We believe it's critical for our customers to have all the necessary tools at their fingertips in order to make the best possible financial decisions for their family and their future.

To see Goal Planning in action, click here.