Tensions in the Middle East have escalated following a surprise attack by Israel on June 13th that targeted Iranian nuclear facilities and military leadership, plunging both countries into a period of direct conflict. While the reaction from global leaders has been mixed, the U.S. administration continued to pressure Iran to surrender the country's nuclear ambitions.

The U.S. military subsequently entered the conflict by deploying sophisticated technology to target sites in Iran believed to be related to uranium enrichment and the development of nuclear weapons. As at the time of writing, a fragile ceasefire has been agreed, however many questions remain unanswered. In this article, we provide some perspective on the recent developments, along with important insights to help investors remain on track with their long-term goals and objectives.

Energy Markets in Focus

Energy markets are one area which have been quick to respond to heightened regional tensions. The price of WTI Crude Oil surged by over 10% in the days immediately following the outbreak of renewed conflict, before unwinding on signs of de-escalation.

Worries so far have centered on the potential for disruption in the production and supply of crude oil. It's estimated that about a third of the world’s seaborne oil supplies pass through the Strait of Hormuz, a narrow waterway which separates Iran from neighboring gulf states. Any act of retaliation or escalation which targets this shipping route could have ramifications on geopolitical tensions and energy markets.

While oil may represent a key means of transmitting Middle East tensions to global financial markets, it's important to note that the broader economic impact of such a price shock today is much lower than in preceding decades. According to FactSet, for example, it took 2.8 barrels of oil per day to generate $1 million of U.S. GDP back in 1975. By 2023, this figure had declined by 70% due primarily to rising industrial efficiency, faster growth of the less energy-intensive service sector and the rise of renewable energy.

The U.S. remains the largest single oil producer globally, representing around 20% to total output. Although oil prices remain subject to global supply and demand factors, the self-sufficiency of U.S. production further limits the domestic impact of energy supply shocks and uncertainty in the Middle East.

Conflict and Financial Markets

Historically, market reactions to military conflict have often been short and quickly reversed, so the probability of a more severe and protracted scenario currently remains low. As an example, the Iraq War, which began in March of 2003, initially weighed on performance of the S&P 500 Index of large-cap U.S. equities, but short-term uncertainty gave way to longer term gains, with double-digit returns in the 12-month period that followed ultimately rewarding patient investors.

From a financial market perspective, the Iraq war was not a unique period. Looking back over the last 50 years, be it the Iran-Iraq war in the 1980s, war in Afghanistan in the 2000s, or even more recently with the Russian invasion of Ukraine in 2022, the pattern of how markets respond has remained consistent.

The outbreak of conflict understandably creates a period of heightened anxiety as headlines stir emotions and tempt investors to become more cautious. Frequently, this has led to shorter term pullbacks in financial markets over the weeks and months following the onset of conflict, before longer term perspective prevailed with a renewed focus on the fundamental drivers of growth.

Market Resilience

At the height of geopolitical or market uncertainty, individuals may be tempted to make investment decisions that put their long-term financial goals at risk. In such periods it is important to keep volatility in perspective.

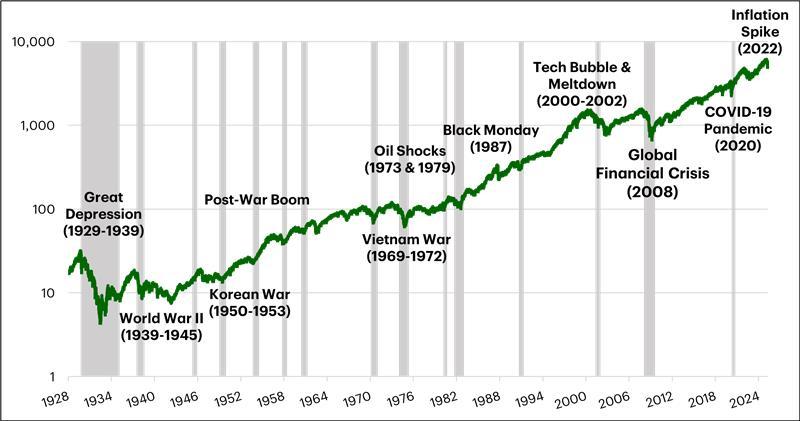

The S&P 500 Index has endured periods of economic stagflation, geopolitical tensions and wars, the bursting of a technology bubble, a global financial crisis and the COVID-19 pandemic. While the drivers and time periods may differ, history has shown that economies and financial markets are often more resilient than expected.

Markets May Be Quick to React, but Investors Don’t Need to Be

We've already seen periods of volatility in the markets so far in 2025, but often the biggest threat to investing success is not the source of uncertainty but how investors respond.

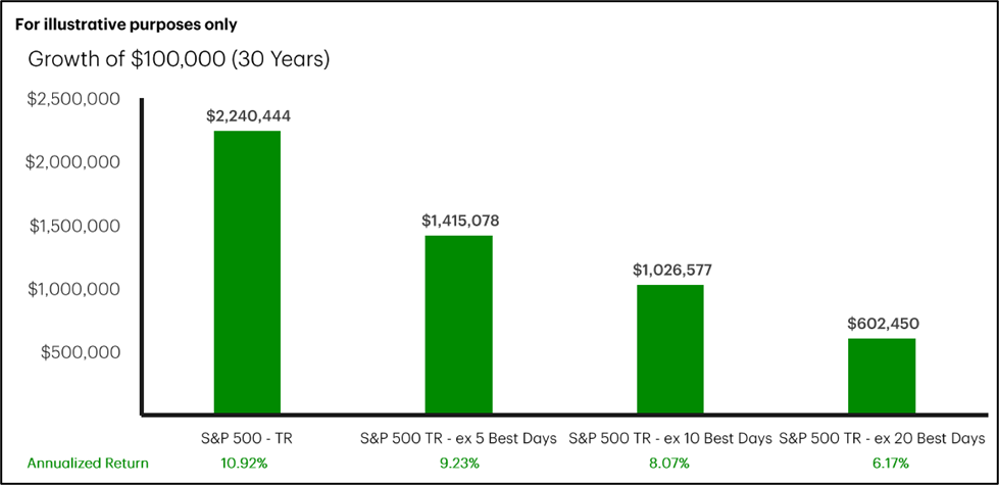

Conflict in the Middle East and heightened geopolitical tensions are likely to create continued headline risk and periods of volatility. Markets may be quick to react, but investors don’t need to be. The chart below shows the value of $100,000 over 30 years for an investor fully invested in the S&P 500 Index during that period, compared to investors who had missed the 5, 10 or 20 highest returning days. Oftentimes, strong up days for equities follow substantial down days.

Historically, investors who have focused on a long-term plan have achieved greater outcomes by not missing those days.

Final Thoughts

TD Wealth continues to take a risk-managed, high-quality approach to investing. While the type of conflict and geopolitical tensions we've seen recently can create a significant amount of uncertainty, it is important for investors to continue focusing on their long-term investment plan.

Periods of heightened volatility can also serve as an important reminder of the benefits of a diversified portfolio. Maintaining thoughtful and well-balanced exposures to a wide range of asset classes, sectors and geographical regions can provide investors with the opportunity to benefit from multiple drivers of return, regardless of the market environment. It is our belief that this approach will continue to serve investors well in helping to ultimately achieve their longer-term financial goals and objectives.

TD Wealth® Important Information

TD Wealth® is a business of TD Bank N.A., member FDIC (TD Bank). TD Wealth ® provides its clients access to bank and non-bank products and services. Banking, lending, investment and trust services are available through TD Bank. Securities and investment advisory services are available through TD Private Client Wealth LLC, a US Securities and Exchange Commission registered investment adviser and broker-dealer and member FINRA/SIPC (TDPCW). Epoch Investment Partners, Inc.(Epoch) is a US Securities and Exchange Commission registered investment adviser that provides investment management services to TD Wealth. TD Bank, TDPCW and Epoch are affiliates.

The information contained herein is current as of June 24, 2025, and is for informational purposes only. The information and perspectives provided in this Market Reflections are expressions of opinion that are subject to change without notice based on shifting market conditions. The information contained herein includes estimated projections of general market performance and economic conditions and are not intended as an offer or recommendation to invest in any specific product, plan or strategy or as a promise of future performance. The views expressed are subject to change without notice based on economic, market, and other conditions and should not be relied upon when making investment decisions.

Graphs and charts are used for illustrative and informational purposes only and do not reflect future values or future performance of any individual investor. Information and data provided have been obtained from sources deemed reliable. However, its accuracy, completeness, or reliability cannot be guaranteed.

The policy analysis does not constitute and should not be interpreted as an endorsement of any political party by TD Bank, N.A. or any of its affiliates.

By receiving this information, you agree with the intended purpose described above. TD Wealth and its affiliates and representatives do not suggest that the recipient take a specific course of action or any action at all.

TD Wealth and its representatives do not provide legal, tax or accounting advice. Prior to making any investment or financial decisions, an investor should seek the individualized advice of their personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's specific situation. TD Wealth and its affiliates are not liable for any errors or omissions, and you understand that TD Wealth is not responsible for any loss sustained by any investor who relies on this communication.

Investing in securities involves risk of loss that clients should be prepared to bear. The investment performance and success of any particular investment cannot be predicted or guaranteed, and the value of a client’s investments will fluctuate due to market conditions and other factors. Investments are subject to various risks, including, but not limited to, market, liquidity, currency, economic and political risks, and will not necessarily be profitable. Past performance of investments is not indicative of future performance. Diversification is not a guarantee against loss.

No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. All rights reserved. All trademarks are the property of their respective owners.

The TD and TD Wealth logo and other trademarks are the property of The Toronto-Dominion Bank or a wholly-owned subsidiary, in Canada and/or other countries.