The first quarter of 2025 was a tale of two halves. Financial markets started the year on a positive note, supported by optimism around the new administration's pro-growth policies, but sentiment shifted in mid-February. Three key factors stood out: concerns over large-cap technology spending following the emergence of Deep Seek, uncertainty stemming from new trade and tariff announcements, and a widening valuation gap between U.S. and international equities, which prompted a rotation toward international markets. The S&P 500 Index declined by more than 4%, while U.S. large-cap growth and small-cap stocks fell nearly 10% for the quarter. However, U.S. large-cap value and international equities delivered positive returns (2% and nearly 7%, respectively) and fixed income saw a flight to safety, with the broad U.S. bond market gaining close to 3%. Thus, investors with diversified portfolios across asset classes and sub classes were less impacted by the pullback, highlighting the importance of maintaining balanced exposure.

Watch the video below to learn more.

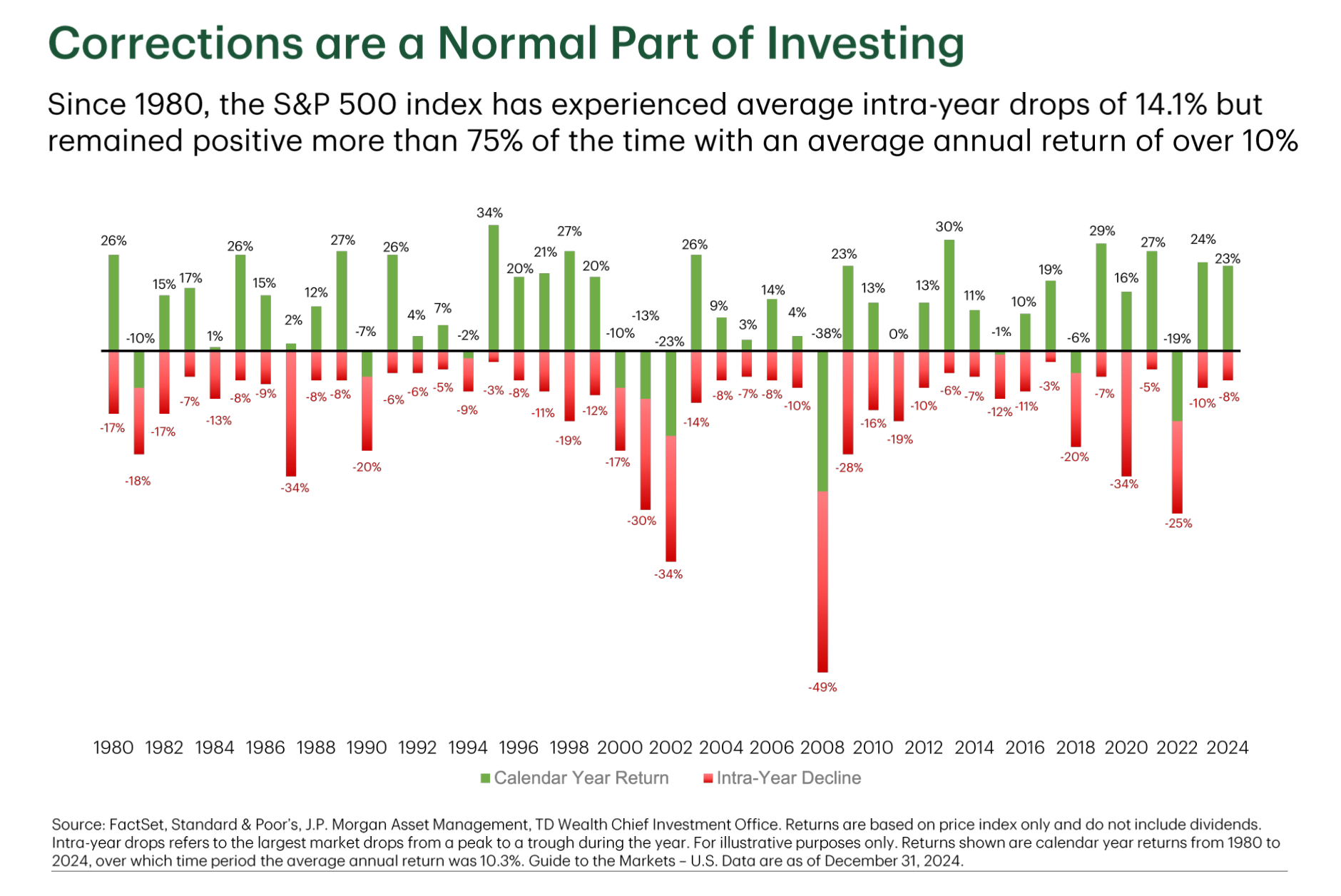

Although market pullbacks can cause anxiety, it's important to put volatility in context. Over the past 45 years, the average intra-year pullback for the S&P 500 Index was over 14%. Yet, despite these pullbacks, 75% of those years ended with a positive return, and the average annual return was over 10%.

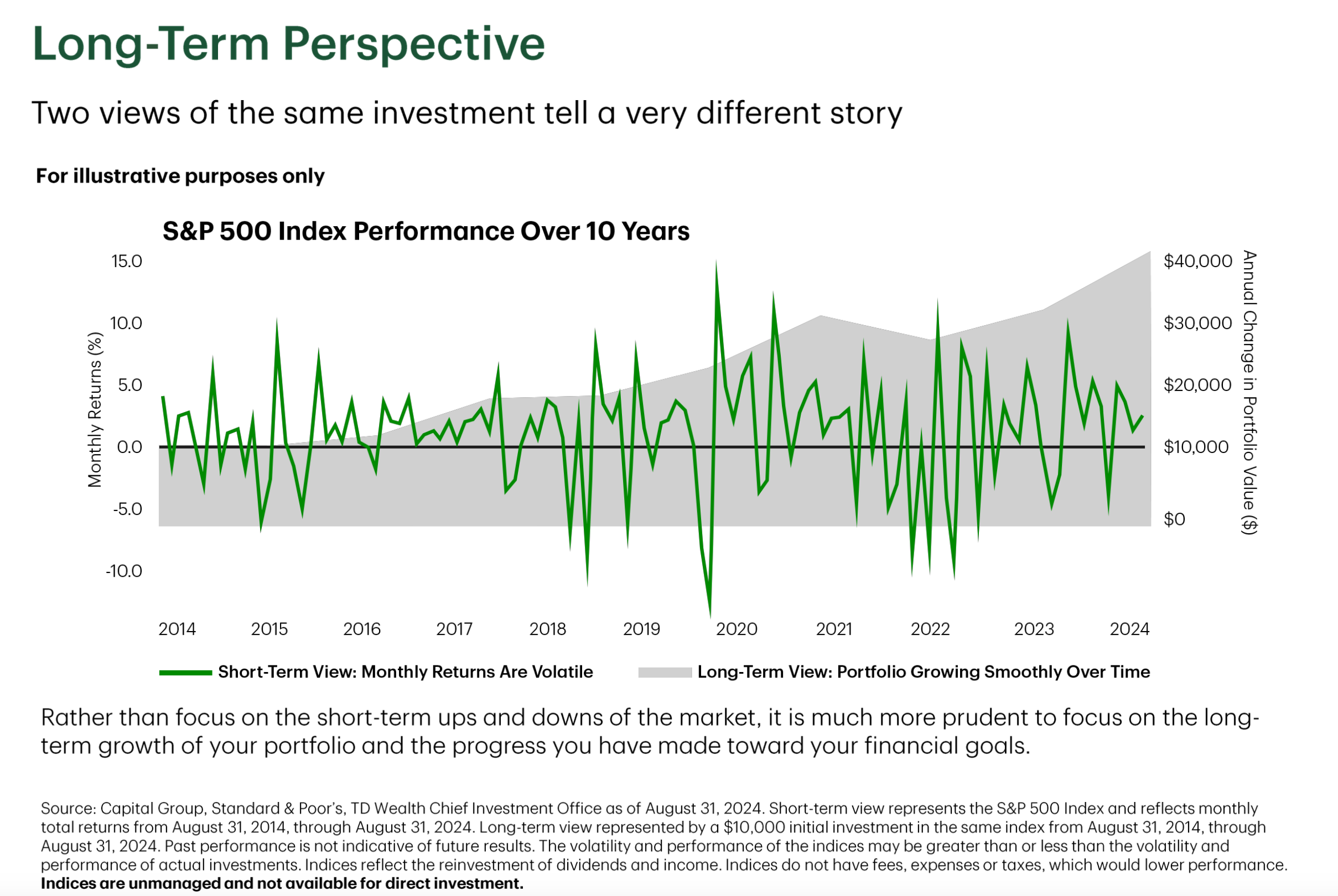

Similarly, monthly S&P 500 returns over the past decade include many instances of sharp declines; yet investors that stayed invested through the gyrations experienced strong outcomes.

Uncertainty around tariffs, government efficiency, and immigration policy has contributed to the Federal Reserve (Fed) taking a more cautious stance in 2025. While two rate cuts are still expected this year, they are likely to come later in 2025, as the Fed waits to better understand how tariffs will impact inflation, employment, and growth.

Much will depend on the level, scope, and duration of the tariffs. Higher levels, more countries impacted, and prolonged tariffs, raise the risk of elevated inflation, slower economic growth, and rising unemployment. The recently announced universal 10% tariff, along with reciprocal measures, signals a more aggressive stance than initially expected. However, negotiations remain ongoing, and exemptions or a narrowing in scope are still possible. We expect to see some moderation in the level and scope of tariffs as negotiations with countries commence.

Another point to consider is that unlike President Trump's first term, when the administration led with positive policy developments, followed by tariff-related uncertainty; this term has opened with tariff uncertainty upfront. Importantly, we need to remember that the Trump administration is also focused on pro-growth policies such as deregulation and cutting taxes. Investors should keep in mind that while uncertainty is in today's headlines, also think about the potential positives ahead.

I recently returned from Europe and the flight back was bumpy, an experience that serves as a helpful analogy. When a plane hits turbulence, the captain advises passengers to stay seated and buckled in. It's natural to feel uneasy, but the turbulence eventually passes. It's similar when you face market volatility. Volatility can be unsettling, but remaining anchored to your financial plan, like remaining seated and calm during turbulence, is essential. Just as a seatbelt offers protection, diversification helps cushion market shocks, and patience is often rewarded.

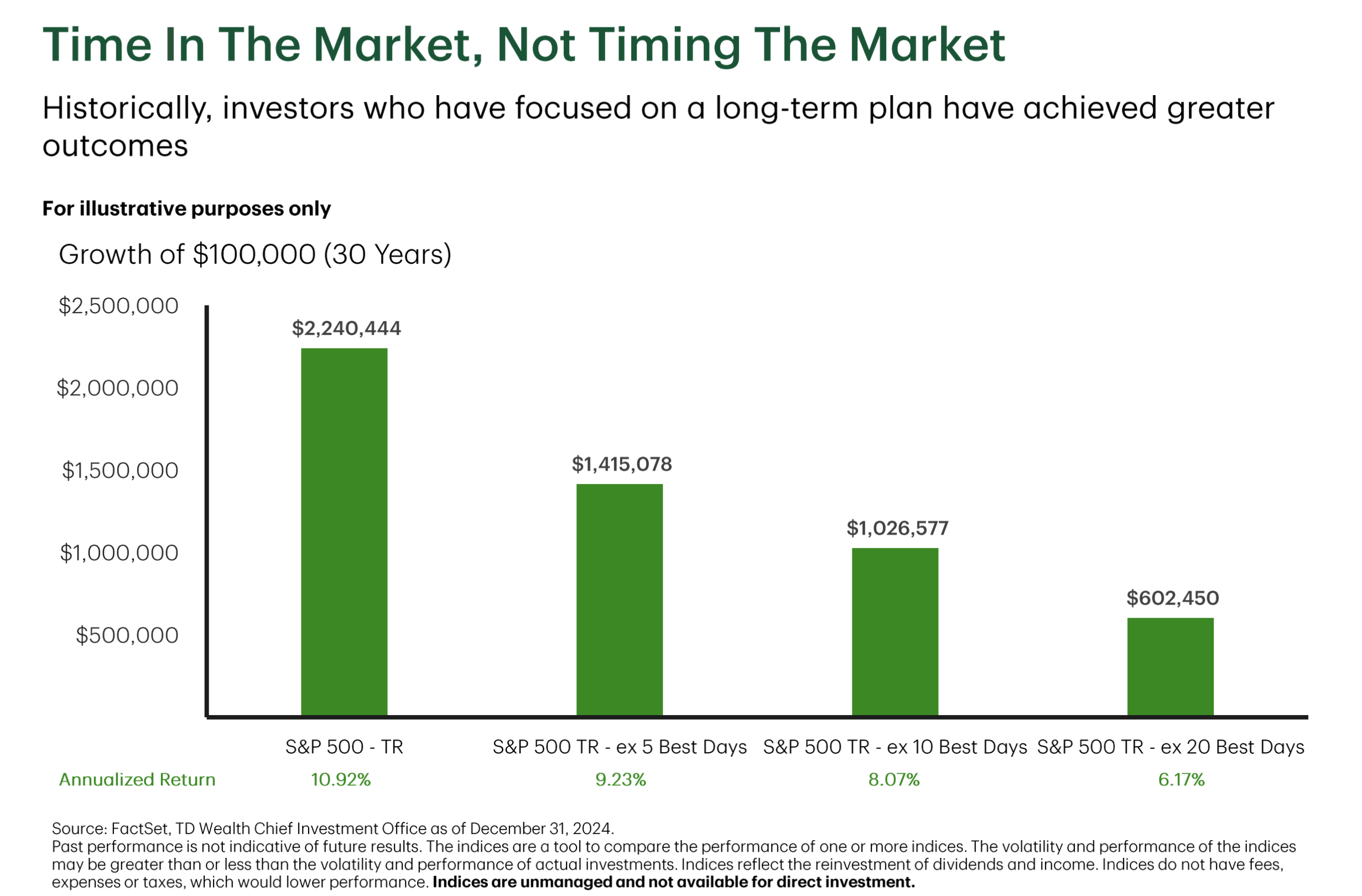

One of the key lessons from the 2008 financial crisis is that investors that sold during the downturn missed the strong recovery that followed. Time in the market matters. For example, an investor who put $100,000 into the S&P 500 Index thirty years ago and stayed invested, saw their account grow to over $2 million by the end of 2024. However, missing just the ten best days would have cut that in half.

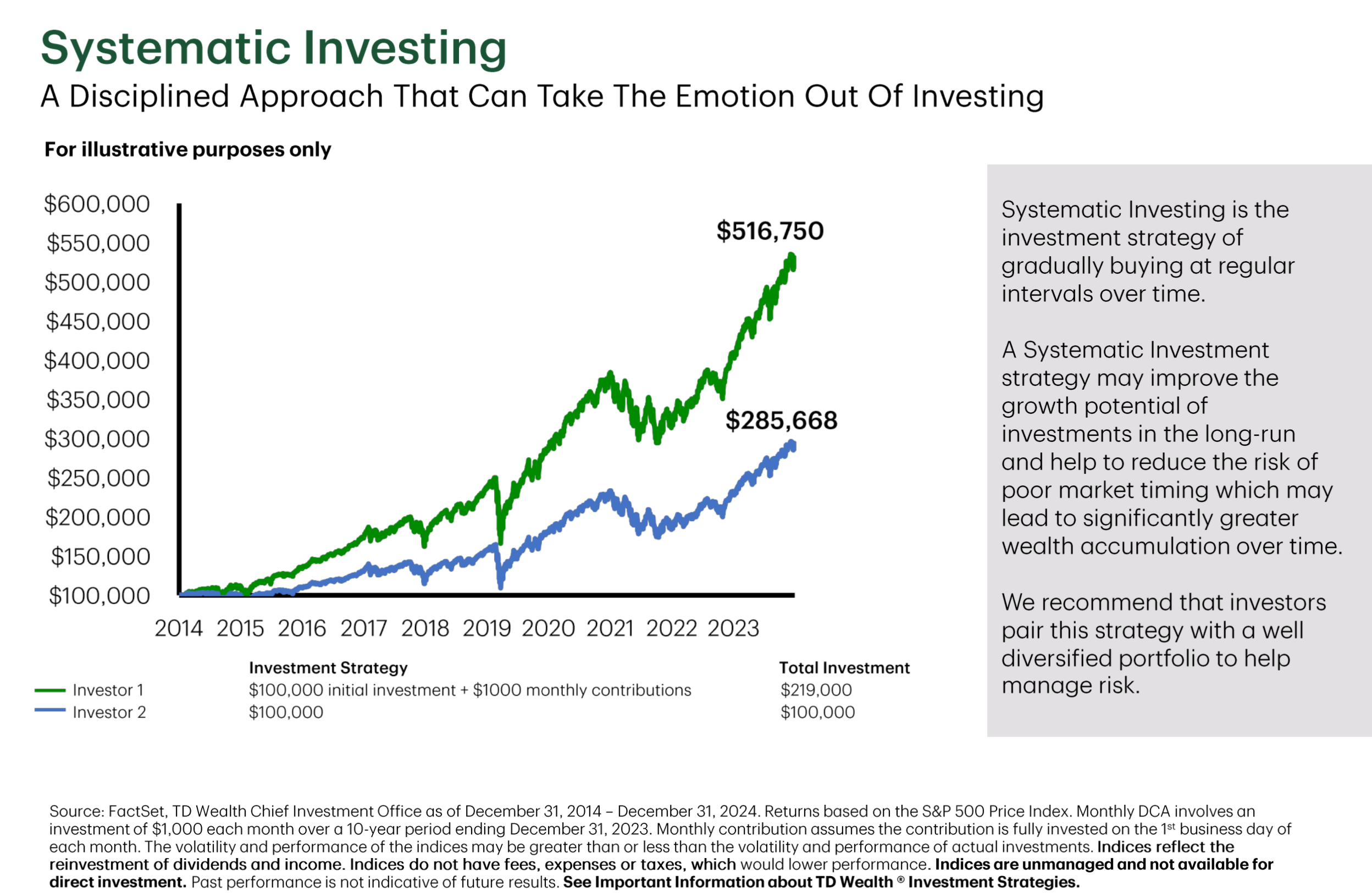

Lastly, I would encourage investors to think about how far out their financial destination is. If your objectives are five, ten, or more years away, periods of market volatility can present opportunity. An effective way to take advantage of this is through a systematic investing plan. Making regular contributions can help reduce the impact of timing and turn volatility into a long-term advantage. For those less comfortable with regular contributions, an indexed annuity may be worth considering. It gives you an opportunity to participate in up markets, while limiting the downside in tougher market conditions. As always, I recommend speaking with your advisor to determine which strategies best align with your financial destination. At TD Wealth, our role is not only to guide you through the turbulence, but to also ensure you stay on course toward your financial destination.

TD Wealth® Important Information

TD Wealth® is a business of TD Bank N.A., Member FDIC (TD Bank). Banking, investment management and trust services are available through TD Bank. Securities and investment advisory services are available through TD Private Client Wealth LLC (TDPCW), a US Securities and Exchange Commission registered investment adviser and broker-dealer and member FINRA/SIPC. Epoch Investment Partners, Inc. (Epoch) is a US Securities and Exchange Commission registered investment adviser that provides investment management services to TD Wealth. TD Bank, TDPCW and Epoch are affiliates.

Capital market expectations are estimated projections of general market performance and economic conditions and are not intended as an offer or recommendation to invest in a specific asset or strategy or as a promise of future performance. The views expressed are subject to change without notice based on economic, market, and other conditions. Information and data provided have been obtained from sources deemed reliable but are not guaranteed.

The information contained herein is current as of May 2025 and is for educational purposes only. All expressions of opinion are subject to change without notice based on shifting market conditions. It is general in nature and not intended for as a recommendation for any specific investment product, plan, strategy, or other purpose. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

The policy analysis provided in this article does not constitute and should not be interpreted as an endorsement of any political party.

By receiving this information, you agree with the intended purpose described above. Any examples used in this communication are generic, hypothetical and for informational purposes only. TD Wealth® and its affiliates and representatives do not suggest that the recipient take a specific course of action or any action at all. TD Wealth® and its representatives do not provide legal, tax or accounting advice. Prior to making any investment or financial decisions, an investor should seek the individualized advice of their personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's specific situation. TD Wealth® and its affiliates are not liable for any errors or omissions, and you understand that TD Wealth® is not responsible for any loss sustained by any investor who relies on this communication.be

suitable for all investors.

Investing in securities involves risk of loss that clients should be prepared to bear. The investment performance and success of any particular investment cannot be predicted or guaranteed, and the value of a client’s investments will fluctuate due to market conditions and other factors. Investments are subject to various risks, including, but not limited to, market, liquidity, currency, economic and political risks, and will not necessarily be profitable. Past performance of investments is not indicative of future performance. Diversification is not a guarantee against loss.

TD Bank and its affiliates and related entities provide services only to qualified institutions and investors. This material is not an offer to any person in any jurisdiction where unlawful or unauthorized. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. All rights reserved. All trademarks are the property of their respective owners. The TD logo and other trademarks are the property of The Toronto-Dominion Bank or a wholly-owned subsidiary, in Canada and/or other countries.

©2025, TD Bank, N.A.