Equities extended their positive momentum into the third quarter, building on gains from the prior period. Performance was broad-based across most major asset classes, with small-cap, emerging market, and growth-oriented equities leading the way. Fixed income markets also moved modestly higher as yields declined late in the quarter.

There were three key factors that drove results. First, early in the quarter, the "One, Big, Beautiful Bill Act" (OBBBA) was passed into law. This provided clarity on fiscal policy and reinforced the administration's pro-growth agenda, including incentives aimed at stimulating business investment and consumer spending.

Second, progress on the trade and tariff front brought a welcome respite from prior stalled negotiations, as agreements with major trading partners, including the European Union and Japan, helped eased investor concerns.

Finally, in September, the Federal Reserve (Fed) cut interest rates by 25 basis points (bps), marking a shift in focus from inflation to supporting a softening labor market. This adjustment was interpreted by investors as an early step toward a more neutral policy stance, which helped drive yields lower.

Government Shutdown

Historically, from an economic and market perspective, government shutdowns have been more of an inconvenience than a lasting disruption, with the long-term impact typically limited unless they persist significantly longer. Although estimates suggest that a month-long shutdown could temporarily shave 0.2% from gross domestic product growth, consumer spending generally rebounds once furloughed workers return and receive back pay. The key variable remains duration. The silver lining is that the shutdown may increase the probability of interest rate cuts, with the Fed possibly bringing forward the timeline for reducing the fed funds rate.

Short-Term Volatility in Context

History serves as a useful guide when it comes to navigating short-term volatility.

In 2023, we experienced the regional banking crisis with the bankruptcies of Silicon Valley Bank and Signature Bank. The Fed continued to raise interest rates to combat inflation, and geopolitical tensions rose with the conflict in the Middle East. Yet despite these headwinds, the S&P 500 Index ended the year with a total return of more than 26%.

In 2024, the Fed kept monetary policy restrictive, to the point where investors grew increasingly concerned about recession. The market pulled back by nearly 10% in August, yet the S&P 500 Index ended the year with a gain of nearly 25%.

Over the last 30 years, the S&P 500 Index has experienced an average annual pullback of roughly 14%. Despite this, annual returns have been positive 75% of the time, with an average annualized gain of more than 10%. While volatility can create anxiety, investors that have stayed invested have generally been better placed to achieve their longer-term goals.

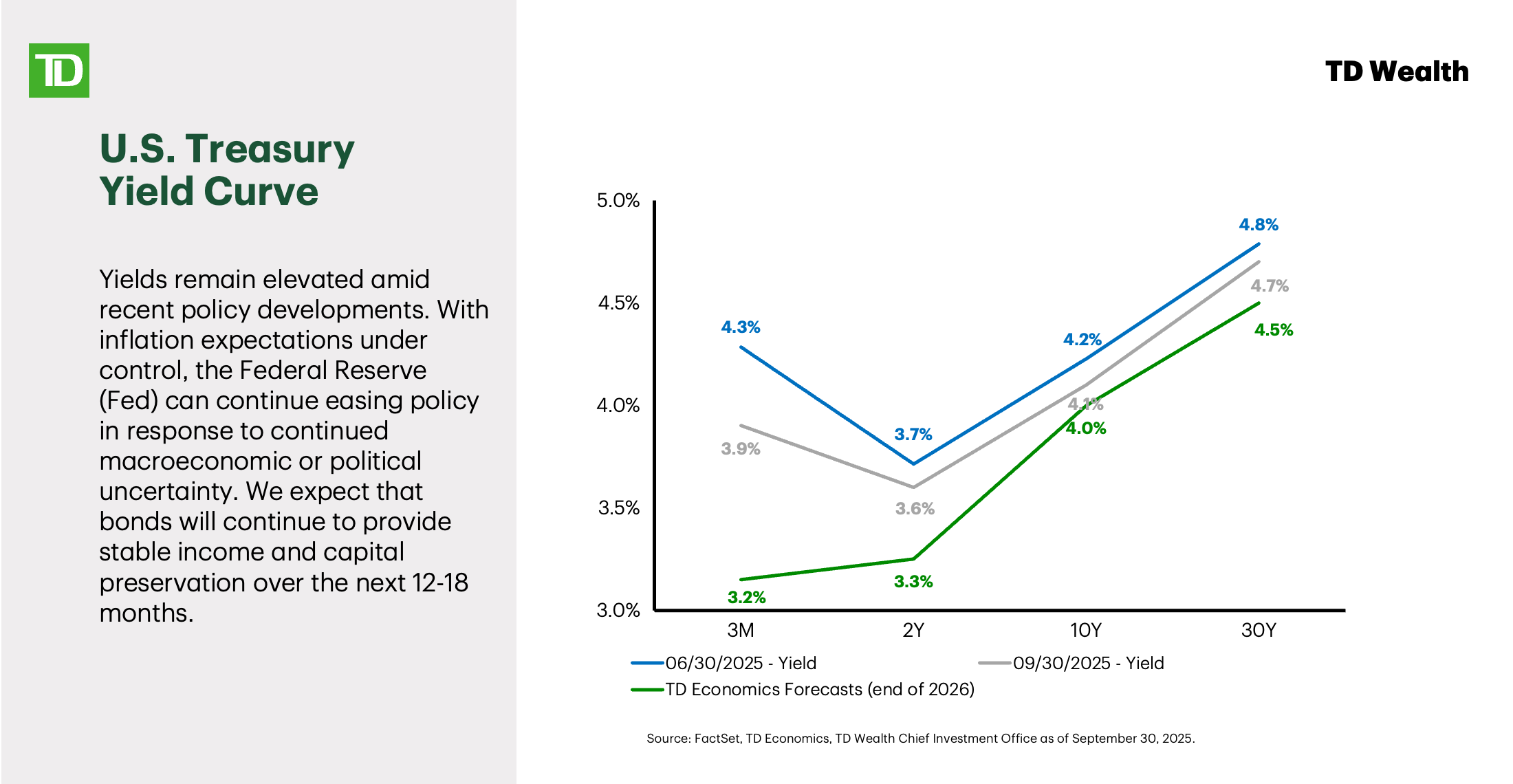

Economic Outlook & Yield Curve

With respect to the economy, there are some short-term challenges but also, longer-term positives. TD Economics' expectation is that inflation will remain elevated but stable, as the impact of higher tariffs continues to be felt by businesses and consumers. The labor market has shown some signs of softening, and the unemployment rate is projected to tick modestly higher over the next six months. Economic growth will also likely remain challenged in the near term, though several positive drivers are anticipated to support a reacceleration in growth in the second half of 2026.

On monetary policy, it's important to recall the Fed's dual mandate of maintaining price stability and supporting maximum employment. For the better part of the past three years, the Fed has focused on combating inflation. However, with signs of softness in the labor market, policymakers have begun shifting their focus toward supporting employment. Following the October interest rate cut, TD Economics expects an additional 25 bps of cuts in the fourth quarter, with a further 50 bps in 2026, bringing the fed funds rate to a 3.00%-3.25% range by the end of 2026.

Given this backdrop, the forecast is for the yield curve to steepen. Short-term rates are expected to move lower in tandem with Fed rate cuts, with the longer end remaining more closely anchored near current levels. Elevated inflation, persistent deficit spending, questions around Fed independence, and an expected pickup in growth should keep the longer end of the curve elevated.

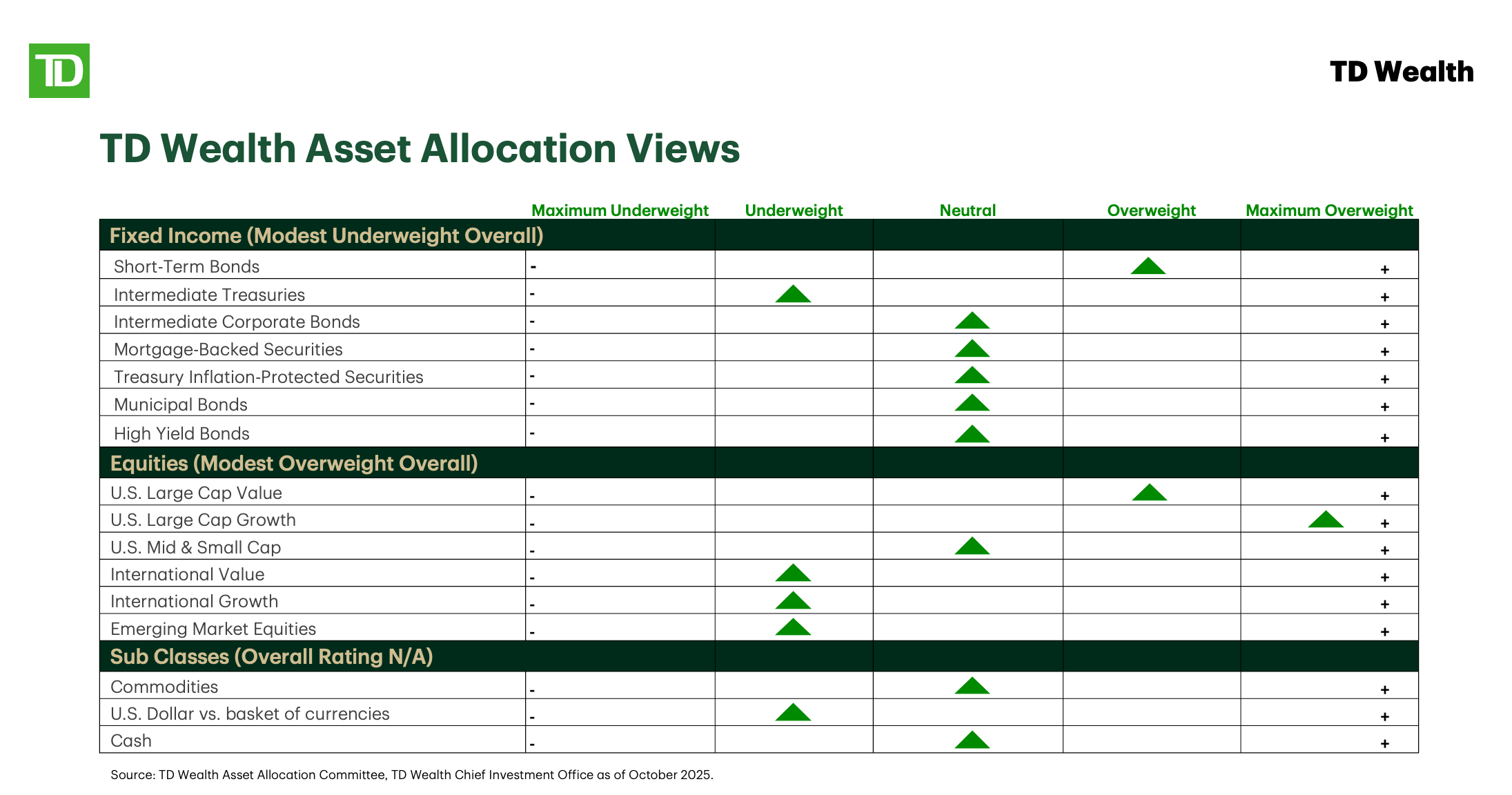

Asset Allocation Views

We remain modestly overweight equities, modestly underweight fixed income, and neutral on cash. Within equities, we favor U.S. over international markets and large-caps over small-caps.

Several catalysts support this view, including additional Fed rate cuts and the recently passed OBBBA. The OBBBA introduces key incentives for businesses and consumers that will take effect next year and, with it now passed, allows the administration to shift focus toward deregulation initiatives, both of which should support growth and business sentiment. Furthermore, continued investment in artificial intelligence represents a positive longer-term structural theme, while strong corporate earnings remain the foundation supporting equities.

On the fixed income front, all-in yields remain attractive. We expect fixed income to continue to provide stable income and diversification benefits. Additionally, the Fed has room to ease later this year and into 2026. We prefer high-quality segments and short- to intermediate-term maturities.

Key Investing Principles

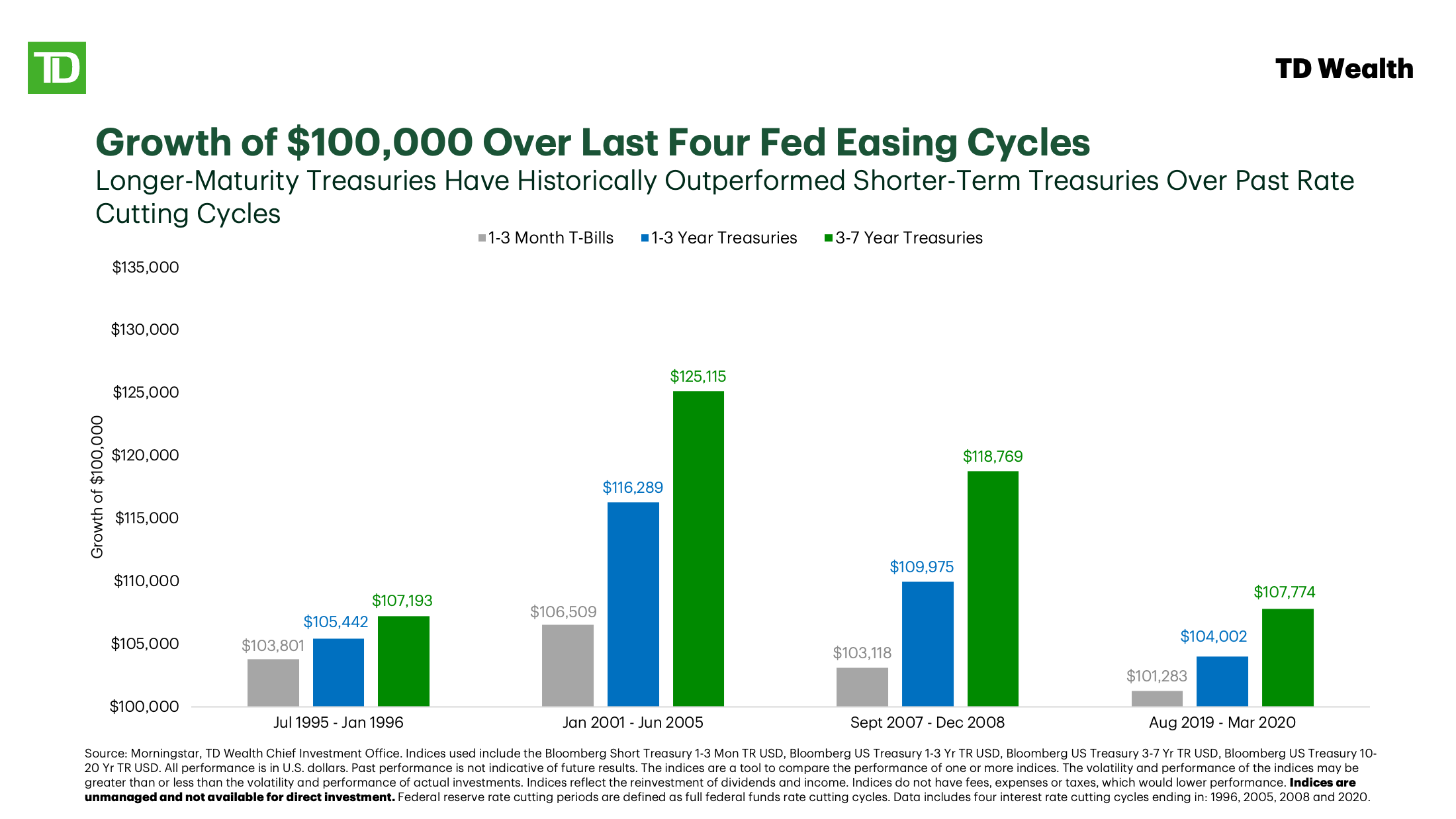

In recent years, many investors favored cash and short-maturity bonds as yields climbed upwards of 5%. That backdrop is now shifting, presenting both opportunity and risk. The Fed has cut rates meaningfully over the past year, and we expect additional cuts ahead, with the fed funds rate ending 2026 in the 3.00%-3.25% range. In prior rate-cutting cycles, cash and short-term instruments have significantly underperformed longer-maturity bonds.

In equity markets, the past three years have delivered very strong returns. As a result, some investors may be hesitant to add new capital, preferring to wait for a pullback before committing additional funds. Looking at the data over the past 25 years, investing at an all-time high for the S&P 500 produced results comparable to, or often better than investing on any random day. When positive catalysts are in place, markets often demonstrate continued momentum.

Final Thoughts

Staying invested and overcoming hesitation to put new money to work in the current environment are important concepts. Another is considering investing systematically. By adding to an account in smaller, consistent increments, whether bi-weekly, monthly, or quarterly, investors can use short-term volatility to their advantage through dollar-cost averaging. This allows investors to take advantage of lower prices during periods of market fluctuations.

For those comfortable making a lump-sum investment, that remains an effective strategy. But for others, a disciplined, systematic plan offers a way to continue building exposure over time, ultimately putting investors in a stronger position to achieve their long-term goals.

TD Wealth® Important Information

TD Wealth® is a business of TD Bank N.A., Member FDIC (TD Bank). Banking, investment management and trust services are available through TD Bank. Securities and investment advisory services are available through TD Private Client Wealth LLC (TDPCW), a US Securities and Exchange Commission registered investment adviser and broker-dealer and member FINRA/SIPC. Epoch Investment Partners, Inc. (Epoch) is a US Securities and Exchange Commission registered investment adviser that provides investment management services to TD Wealth. TD Bank, TDPCW and Epoch are affiliates.

Capital market expectations are estimated projections of general market performance and economic conditions and are not intended as an offer or recommendation to invest in a specific asset or strategy or as a promise of future performance. The views expressed are subject to change without notice based on economic, market, and other conditions. Information and data provided have been obtained from sources deemed reliable but are not guaranteed.

The information contained herein is current as of October 30, 2025 and is for educational purposes only. All expressions of opinion are subject to change without notice based on shifting market conditions. It is general in nature and not intended for as a recommendation for any specific investment product, plan, strategy, or other purpose. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

The policy analysis provided in this article does not constitute and should not be interpreted as an endorsement of any political party.

By receiving this information, you agree with the intended purpose described above. Any examples used in this communication are generic, hypothetical and for informational purposes only. TD Wealth® and its affiliates and representatives do not suggest that the recipient take a specific course of action or any action at all. TD Wealth® and its representatives do not provide legal, tax or accounting advice. Prior to making any investment or financial decisions, an investor should seek the individualized advice of their personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's specific situation. TD Wealth® and its affiliates are not liable for any errors or omissions, and you understand that TD Wealth® is not responsible for any loss sustained by any investor who relies on this communication.be

suitable for all investors.

Investing in securities involves risk of loss that clients should be prepared to bear. The investment performance and success of any particular investment cannot be predicted or guaranteed, and the value of a client’s investments will fluctuate due to market conditions and other factors. Investments are subject to various risks, including, but not limited to, market, liquidity, currency, economic and political risks, and will not necessarily be profitable. Past performance of investments is not indicative of future performance. Diversification is not a guarantee against loss.

TD Bank and its affiliates and related entities provide services only to qualified institutions and investors. This material is not an offer to any person in any jurisdiction where unlawful or unauthorized. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. All rights reserved. All trademarks are the property of their respective owners. The TD logo and other trademarks are the property of The Toronto-Dominion Bank or a wholly-owned subsidiary, in Canada and/or other countries.

©2025, TD Bank, N.A.

TD Bank, N.A. | Member FDIC TD Private Client Wealth LLC

Member FINRA/SIPC