Q2 Market Recap

While equities ended the second quarter broadly higher, the period proved to be highly eventful and volatile. The early part of the quarter was largely defined by tariff headlines and investor reaction to the "Liberation Day" announcement, which triggered a sharp pullback in equities. Sentiment quickly recovered following news of a 90-day delay, fueling a swift rebound. Attention then shifted toward fiscal developments, particularly the "One, Big, Beautiful Bill Act" (OBBBA). Additionally, strong corporate earnings and a resilient labor market provided further support for stocks.

Watch the Moneytalk video below with Sid Vaidya, Chief Investment Strategist at TD Wealth, to learn more about his outlook for the remainder of 2025 and how investors should be positioned moving forward.

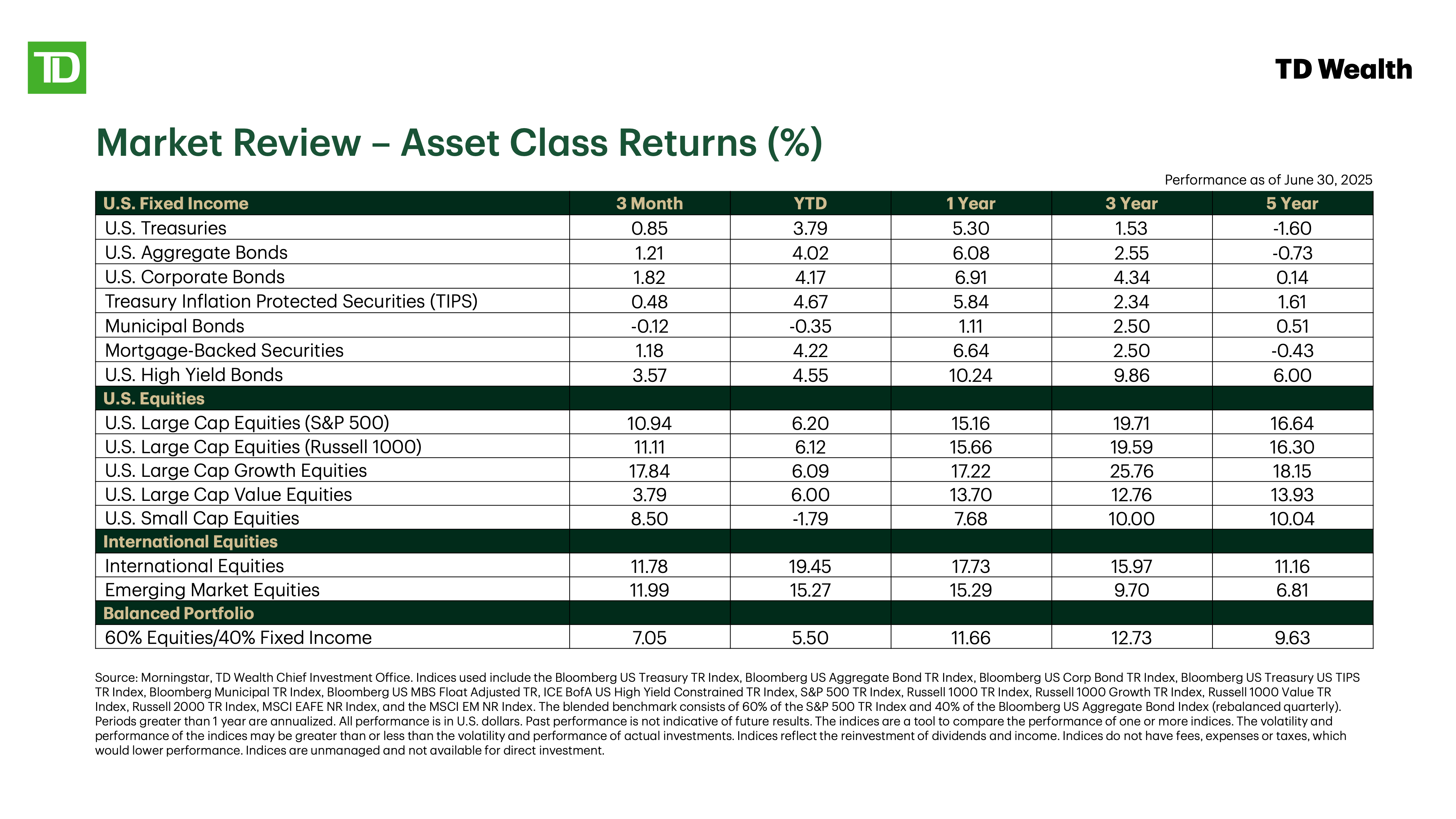

The S&P 500 Index rose nearly 11%, while the Nasdaq Composite Index surged close to 18%. U.S. large-cap stocks outperformed small-caps, and growth led value. International equities also performed well, supported by a weaker U.S. dollar. Fixed income returns were more muted, with the Bloomberg Aggregate Bond Index up just over 1%. Treasury prices were mixed, with longer-term Treasuries underperforming short- and intermediate-term maturities. Fiscal deficit concerns and rising Treasury issuance weighed on the long end of the curve. Meanwhile, credit markets were supported by attractive all-in yields.

With equities and bonds both positive year-to-date, the first half of 2025 reinforced the importance of staying invested through uncertainty and the value of diversification, as leadership rotated across segments.

Trade, Tariffs, and Inflation

Trade and tariff policies have remained very fluid, with new developments emerging seemingly weekly. This has created a volatile environment with investors reacting to headlines but quickly refocusing as details evolve. For now, investors appear to be discounting the broader impact of tariffs, which isn't entirely surprising. We haven't seen a meaningful passthrough in higher prices yet, largely because many businesses front-loaded imports earlier in the year to get ahead of potential cost increases. This has helped limit price increases thus far.

That said, we're beginning to see signs of upward price pressure. As tariffs remain in place, we expect more flow-through to consumer prices in the months ahead. The latest consumer price index report, which showed a rise in June inflation, may be an early indication of that.

OBBBA: Key Elements

On July 4, 2025, President Trump signed the OBBBA into law. Key elements of the bill include:

- The Tax Cut and Jobs Act was extended, the State and Local Tax Deductions cap was raised to $40k, deductions of tips and overtime pay as well as deductions on social security income were passed.

- In terms of spending, Medicaid and Supplementary Nutrition Assistance Program spending are likely to decrease, while funding for immigration and defense increased.

- In the aggregate, the budget bill is set to significantly augment fiscal deficits over the next 10 years, with estimates running in the $3-$4 trillion range.

The bill also raised the debt ceiling by $5 trillion after its reinstatement at $36.1 trillion in January. This pushes back the issue likely until mid-2027. The important point for investors is the bill's sequencing and its impact on the primary deficits. In that sense, the OBBBA front-loads the costs (tax cuts & spending) and back-loads the savings (Medicaid/green energy). This means the bill is set to boost activity early on given the new enacted tax cuts (2026-2027), but the impact then fizzles out as spending cuts are gradually triggered.

Economic Outlook

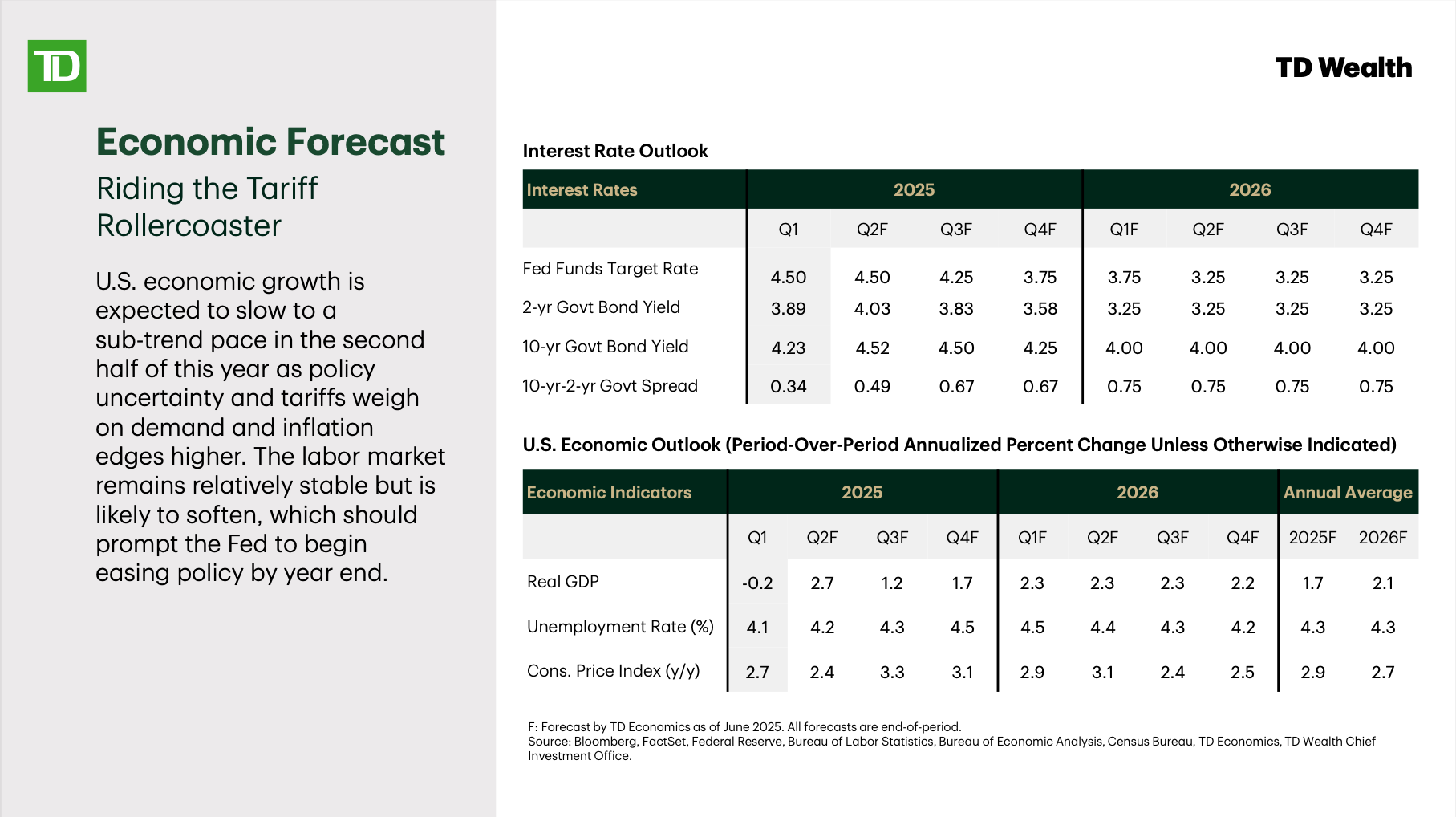

With respect to the economy and the Federal Reserve (Fed), it's helpful to take a step back and assess where we are. While businesses initially front-loaded inventory to avoid passing on costs, that buffer is fading. We're now at a juncture where higher tariffs are expected to begin to feed through to the consumer. As a result, TD Economics expects inflation to rise moderately and growth to soften over the next one to two quarters.

The silver lining is that weaker economic growth will allow the Fed to start cutting interest rates later this year. TD Economics currently expects two to three 25 basis points (bps) cuts in 2025, one in September and two more likely in Q4. They also expect both inflation and unemployment to stabilize by early 2026. Ultimately, our expectation is that the Fed funds rate will be 3.25% by the end of 2026. Looking ahead, lower interest rates, deregulation, and lower taxes under the OBBBA are expected to support a pickup in growth in 2026, even as the near-term outlook looks more challenging.

Asset Allocation Views

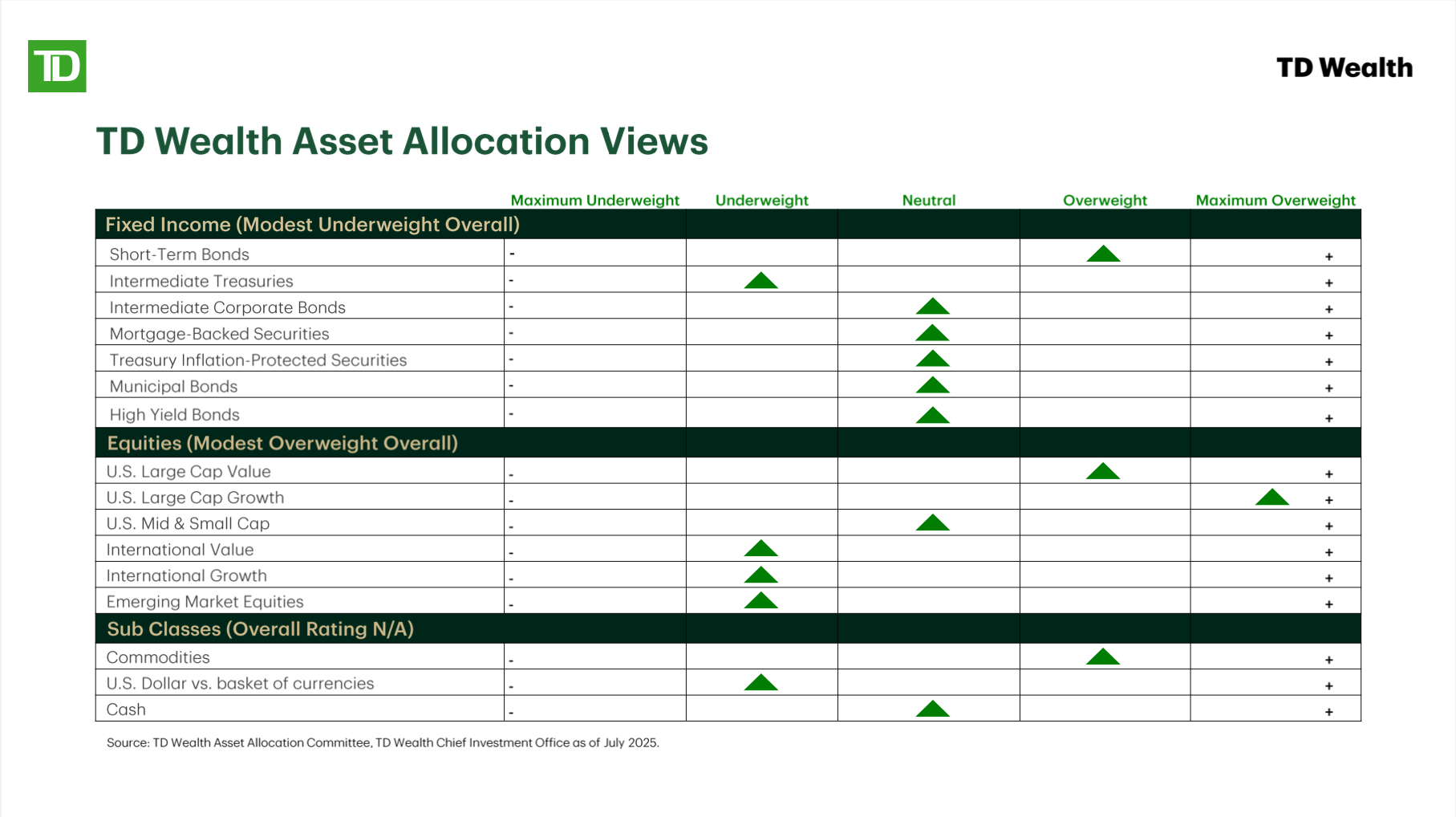

We remain modestly overweight equities, modestly underweight fixed income, and neutral on cash.

The OBBBA is a slight positive for equities, but a modest headwind for fixed income given the increased deficits and the need for higher Treasury issuance. We continue to prefer domestic equities over international. While international equities benefited from earlier U.S. dollar weakness, we don't expect that tailwind to repeat. At the same time, we see no clear catalyst for renewed dollar strength.

On the fixed income side, all-in yields remain attractive. We expect fixed income to continue to provide stable income and diversification benefits. Additionally, the Fed has room to ease later this year and into 2026. We prefer high-quality segments and short- to intermediate-term maturities.

Final Thoughts: The 3 Ps

We've seen significant market movement in 2025. At TD Wealth, we emphasize the importance of the 3 Ps: Plan, Portfolio, and Patience; all essential to helping clients stay focused on their long-term goals. Furthermore, the value of the 3 Ps was clear in the first half of this year.

Having a Wealth Plan helps investors stay anchored on long-term objectives and helps avoid the distractions that come with short-term volatility. Despite headline-driven volatility, balanced investors that stuck with their plan were rewarded. Year to date, the S&P 500 Index has returned roughly 6%, broad fixed income has added about 4%, and international markets have delivered double-digit gains.

Secondly, a diversified portfolio has also been important. In Q1, weakness in U.S. equities were offset by gains in fixed income and international stocks. By Q2, domestic large-cap technology stocks rebounded, and international stocks continued to see momentum, while fixed income took a backseat. Thus, the importance of having a diversified portfolio was fully evident.

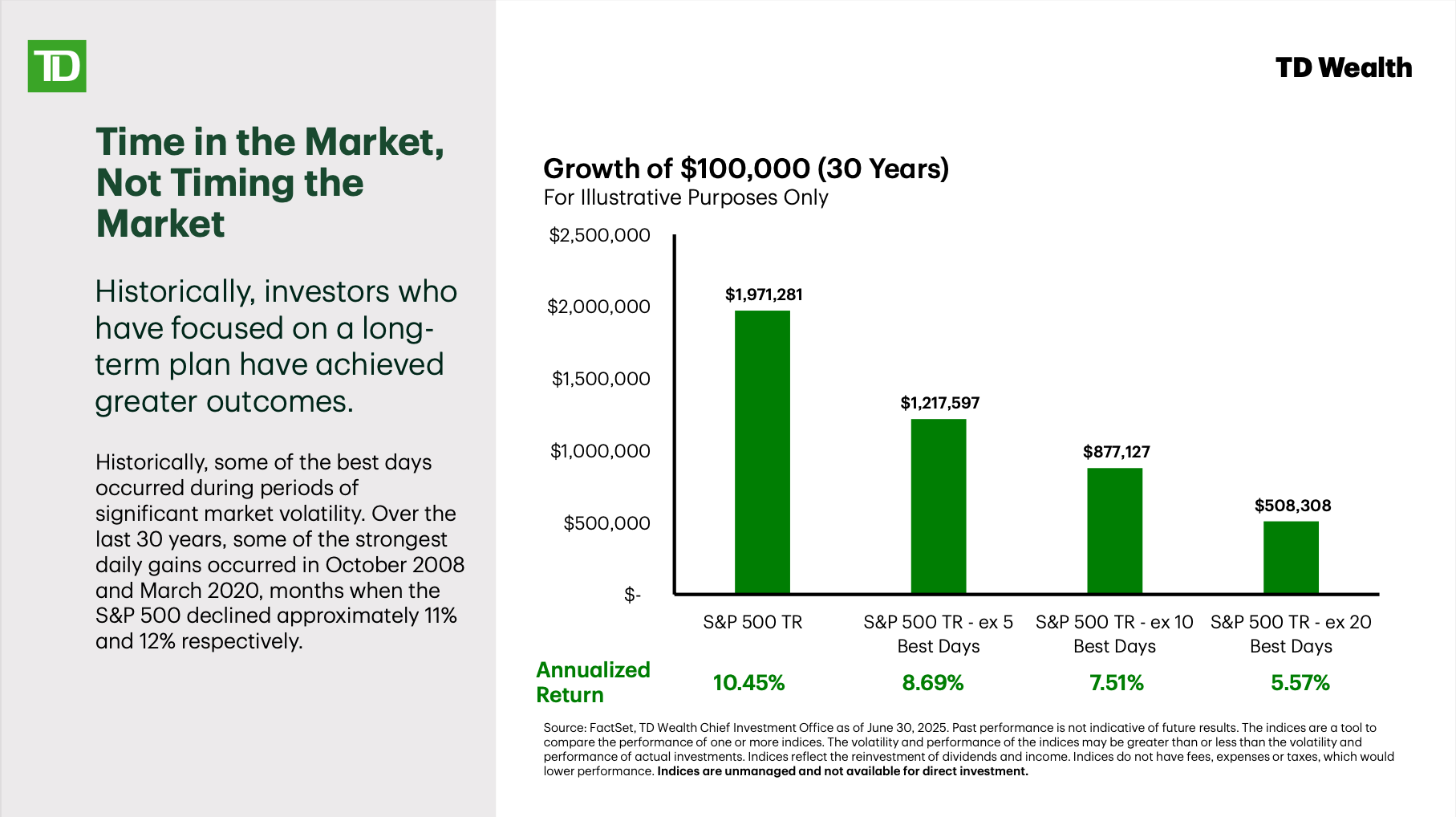

The last point is staying patient and focusing on time in the market rather than trying to time the market. While we faced significant volatility towards the end of Q1 and into Q2, with a nearly 19% drawdown in the S&P 500 Index, investors who remained patient were rewarded. Volatility and market pullbacks are very normal in the investing cycle, and some of the biggest rebounds in markets come after significant pullbacks.

The key message is that having a Wealth Plan in place, using a diversified portfolio to fulfil that plan, and staying patient, are key to achieving your longer-term goals.

TD Wealth® Important Information

TD Wealth® is a business of TD Bank N.A., Member FDIC (TD Bank). Banking, investment management and trust services are available through TD Bank. Securities and investment advisory services are available through TD Private Client Wealth LLC (TDPCW), a US Securities and Exchange Commission registered investment adviser and broker-dealer and member FINRA/SIPC. Epoch Investment Partners, Inc. (Epoch) is a US Securities and Exchange Commission registered investment adviser that provides investment management services to TD Wealth. TD Bank, TDPCW and Epoch are affiliates.

Capital market expectations are estimated projections of general market performance and economic conditions and are not intended as an offer or recommendation to invest in a specific asset or strategy or as a promise of future performance. The views expressed are subject to change without notice based on economic, market, and other conditions. Information and data provided have been obtained from sources deemed reliable but are not guaranteed.

The information contained herein is current as of July 2025 and is for educational purposes only. All expressions of opinion are subject to change without notice based on shifting market conditions. It is general in nature and not intended for as a recommendation for any specific investment product, plan, strategy, or other purpose. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

The policy analysis provided in this article does not constitute and should not be interpreted as an endorsement of any political party.

By receiving this information, you agree with the intended purpose described above. Any examples used in this communication are generic, hypothetical and for informational purposes only. TD Wealth® and its affiliates and representatives do not suggest that the recipient take a specific course of action or any action at all. TD Wealth® and its representatives do not provide legal, tax or accounting advice. Prior to making any investment or financial decisions, an investor should seek the individualized advice of their personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's specific situation. TD Wealth® and its affiliates are not liable for any errors or omissions, and you understand that TD Wealth® is not responsible for any loss sustained by any investor who relies on this communication.

Investing in securities involves risk of loss that clients should be prepared to bear. The investment performance and success of any particular investment cannot be predicted or guaranteed, and the value of a client’s investments will fluctuate due to market conditions and other factors. Investments are subject to various risks, including, but not limited to, market, liquidity, currency, economic and political risks, and will not necessarily be profitable. Past performance of investments is not indicative of future performance. Diversification is not a guarantee against loss.

TD Bank and its affiliates and related entities provide services only to qualified institutions and investors. This material is not an offer to any person in any jurisdiction where unlawful or unauthorized. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. All rights reserved. All trademarks are the property of their respective owners. The TD logo and other trademarks are the property of The Toronto-Dominion Bank or a wholly-owned subsidiary, in Canada and/or other countries.

©2025, TD Bank, N.A.