For many Americans, homeownership is the cornerstone of the American Dream — a symbol of stability, success, and the hope of building something for the next generation. But for tens of thousands of families, that dream becomes a legal nightmare when the title to their home becomes "tangled."

A tangled title occurs when someone- often an heir- lives in a home but their name isn’t on the deed — often because the original owner passed away without a will or estate plan. Without a clear title, families can’t access home repair grants, may lose eligibility for property tax relief, and risk the home falling into disrepair or even foreclosure.

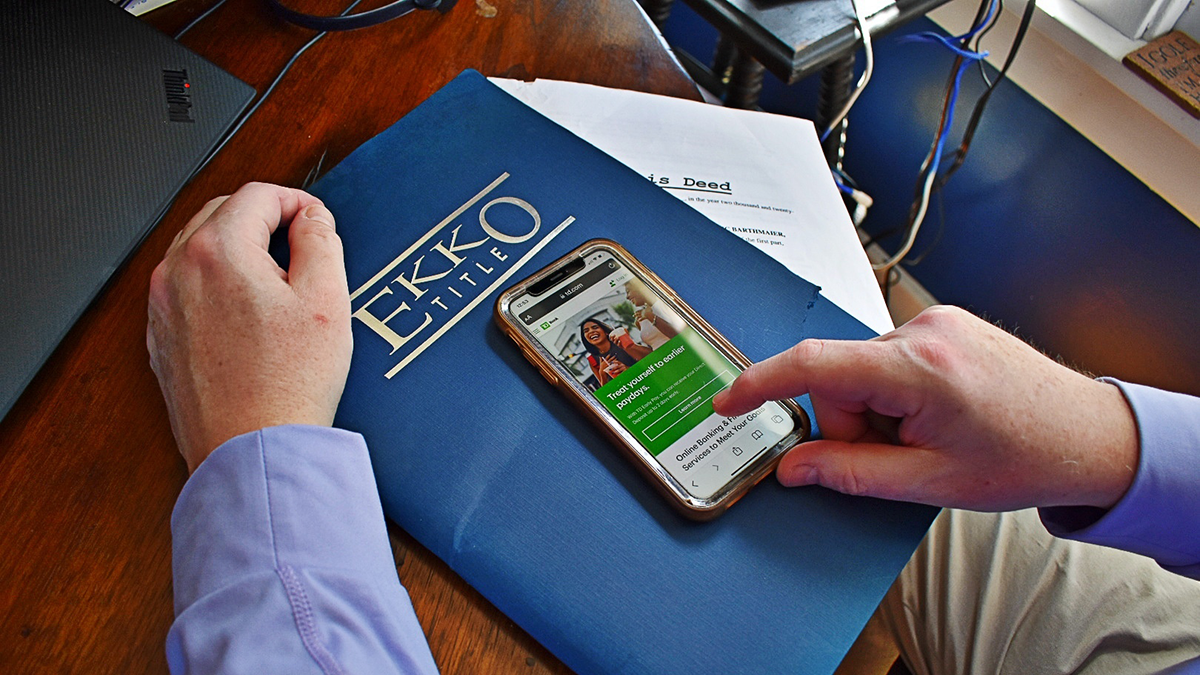

To help address this growing issue, TD Bank collaborated with and provided a grant to NeighborWorks America, a national nonprofit committed to affordable housing and community development. NeighborWorks America's mission is to create opportunities for people to live in affordable homes, improve their lives and strengthen their communities. The funding supports their work to address the complex legal, social, and financial property inheritance challenges that can prevent families from passing down their homes. The grant helps advance peer learning among community development professionals, elevates ongoing discussions on heirs' property, and strengthens the impact of organizations working to preserve generational wealth.

A Legal and Emotional Tangle

While tangled title and heirs' property are often used interchangeably, slight differences exist. Tangled title refers to when a homeowner dies, and the property remains in their name because the title was never legally transferred.

One form of tangled title is heirs’ property, which occurs when a homeowner dies without a will or other estate planning documentation. The property or land is then owned informally by the heirs (multiple generations. But unless the heirs go through a formal legal administrative procedure, the title remains in the name of the deceased ancestor. This is one of the least stable forms of homeownership.

The result in either case is confusion, vulnerability, and instability — especially for communities of color, where homeownership is often the key to intergenerational wealth.

“This could really impact anyone,” explains Hayat Adem, Senior Manager, Corporate Citizenship, TD Bank. “It’s not just a low-to-moderate income issue. It’s about protecting what you’ve built.”

Building the Partnership

In 2024, Hayat and Head of Social Impact at TD Bank, Paige Carlson-Heim, attended the Heirs’ Property Roundtable at the NeighborWorks Training Institute (NTI) in Pittsburgh. That session sparked the beginning of what would become a strategic and multifaceted relationship.

“Immediately following the session, Paige and I sat in the lobby of the hotel and started coming up with ideas about how TD could play a role,” Hayat said.

TD’s support included a direct grant to NeighborWorks America to fund 11 subgrantees to document best practices, surface local challenges, and foster peer learning. TD also sponsored the 2025 NeighborWorks Training Institute (NTI) in Philadelphia, which featured the “Property Inheritance Intensive” — a convening where Carlson-Heim held a fireside chat with NeighborWorks CEO Marietta Rodriguez.

"TD showed up in every way," said Molly Barackman-Eder, Director of Financial Capability at NeighborWorks America. “They didn’t just write a check and disappear. They rolled up their sleeves and helped move the field forward.”

Legal Clinics with Real-Life Impact

TD also activated its internal legal team, partnering with Troutman Pepper Locke and Philly VIP in March 2025 to host a legal clinic for clients in need of drafting estate planning documents, including simple wills, powers of attorney, and advanced medical directives.

Anjum Unwala, Senior Counsel with TD Bank, stressed the emotional weight of the work: “Our team, in partnership with a Troutman Pepper associate, were able to advise a client on updating his medical and financial directives, as well as his will — and put his mind at ease regarding ensuring trusted family members would carry out his wishes.”

Workshops, Awareness, and Community Healing

TD Bank has extended its participation beyond funding and legal work. The Philadelphia NeighborWorks training event brought together more than 100 housing and legal professionals, which included discussion on tangible strategies for tackling tangled titles. One outcome: the birth of a grassroots awareness campaign called “We Will,” designed to spark family conversations about estate planning before a crisis occurs.

“It’s hard to talk about death,” Molly said. "But it’s even harder to navigate a home that no longer legally belongs to anyone.”

At the event, Philadelphia Councilmember Katherine Gilmore Richardson shared her own experience managing three mortgages after the loss of both parents — a powerful reminder that this issue cuts across income levels and professions.

While TD Bank supports tangled title efforts through grants and sponsorships, Hayat emphasized that the work goes far beyond financial support. “We show up. We attend the community events, we sit on workstreams, we listen. That’s how we learn where we’re needed.”

From Philadelphia to New York and beyond, TD colleagues have attended regional events, helped educate homeowners, and continue to explore opportunities to add estate planning materials at the closing table for new homebuyers. “It’s about preventing the problem before it starts,” Hayat said. TD also discovered that tangled titles are more common than many realize — even among employees. “Unsolicited, I’ve had colleagues tell me they’re going through tangled title situations right now,” Hayat said. “That’s why this work matters. It touches more people than we know.”

Advice from the Experts: Estate Planning Tips

Molly notes that many homeowners assume their property will seamlessly transfer to their children or relatives after death — but without proper documentation, that’s rarely the case.

“One of the simplest ways to avoid a tangled title is to leave your home to one person,” she explained. “The more heirs you name, the more complicated it becomes. In most cases, the best option is to decide who you want to inherit the home and ensure they’re listed clearly in the will or even on the deed itself.”

She also encourages people to revisit their estate documents regularly and seek help from a housing agency or nonprofit legal partner to ensure everything is up to date.

Looking Ahead

TD Bank will continue to prioritize efforts in helping people navigate this complex issue.

“Affordable housing and financial security are core to our values at TD and serve as a major focus of our social impact strategy,” Hayat said. “We believe everyone deserves the right to keep the home they’ve worked for and earned.”

Future plans include exploring the opportunity to continue legal clinics, expanding partnerships, and possibly introducing estate planning awareness materials at the mortgage closing stage — a preventative step TD hopes will catch on nationwide.

As tangled titles continue to disrupt lives and legacies, partnerships like this prove that thoughtful, sustained investment can lead to meaningful change.

“Together, we can preserve generational wealth, stabilize neighborhoods, and ensure more families hold onto the homes they’ve worked so hard to maintain,” Molly said.

For more on personal finance topics

If you have more questions about personal finance topics, visit the Learning Center on the TD Bank website. You can find more TD Bank services at TD.com. We hope you found this helpful. This article is for informational purposes only and is based on information available as of June 2025 and is subject to change. This content is not intended to be used or acted upon with respect to any client's specific circumstances. For specific advice about your unique circumstances, consider talking with your qualified professionals.