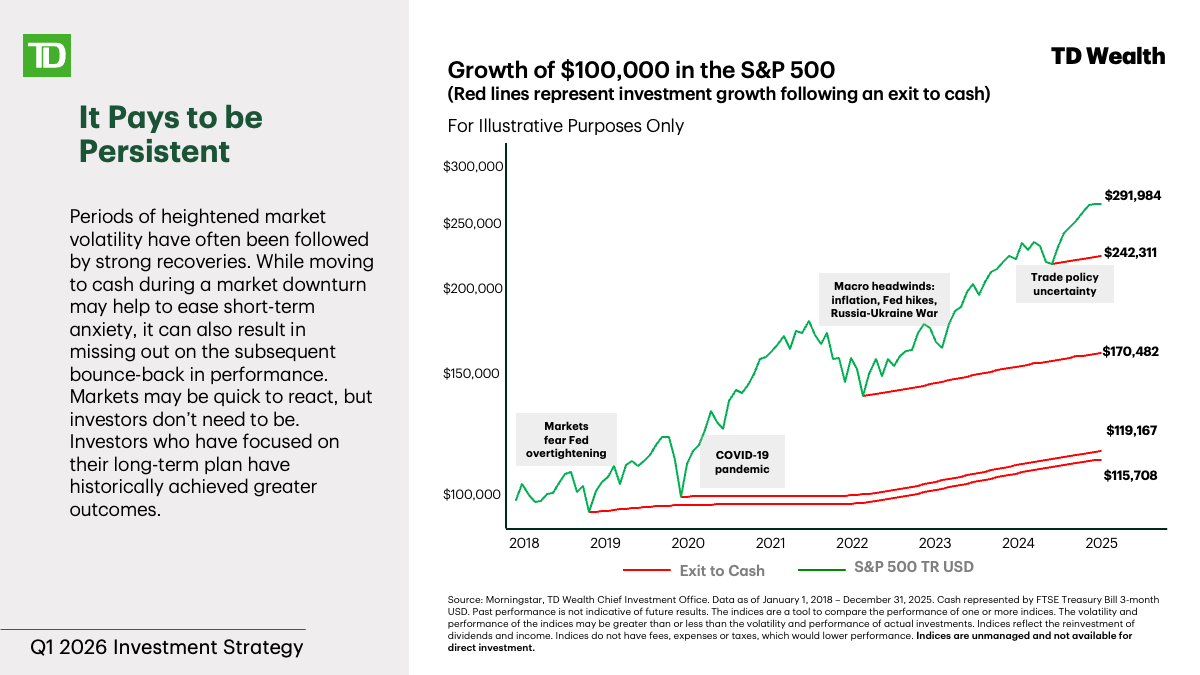

Periods of market volatility can challenge investor confidence, but those who stayed invested through last year’s uncertainty were rewarded for their discipline. Despite shifting policies and evolving trade dynamics, the economy remained resilient while fiscal and monetary policy support, Artificial Intelligence (AI) technology investment, and robust corporate earnings growth helped drive strong returns across equities and fixed income markets. As we look ahead to 2026, a lower interest rate environment, expectations for earnings growth to broaden beyond U.S. mega-cap technology stocks, and supportive fiscal and monetary policies give rise to a constructive outlook for long‑term investors.

Looking Back: Reflecting on Markets in 2025

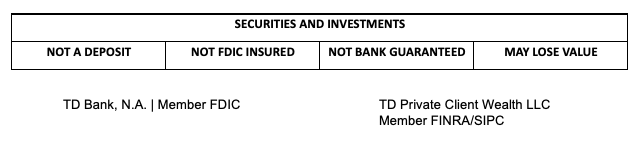

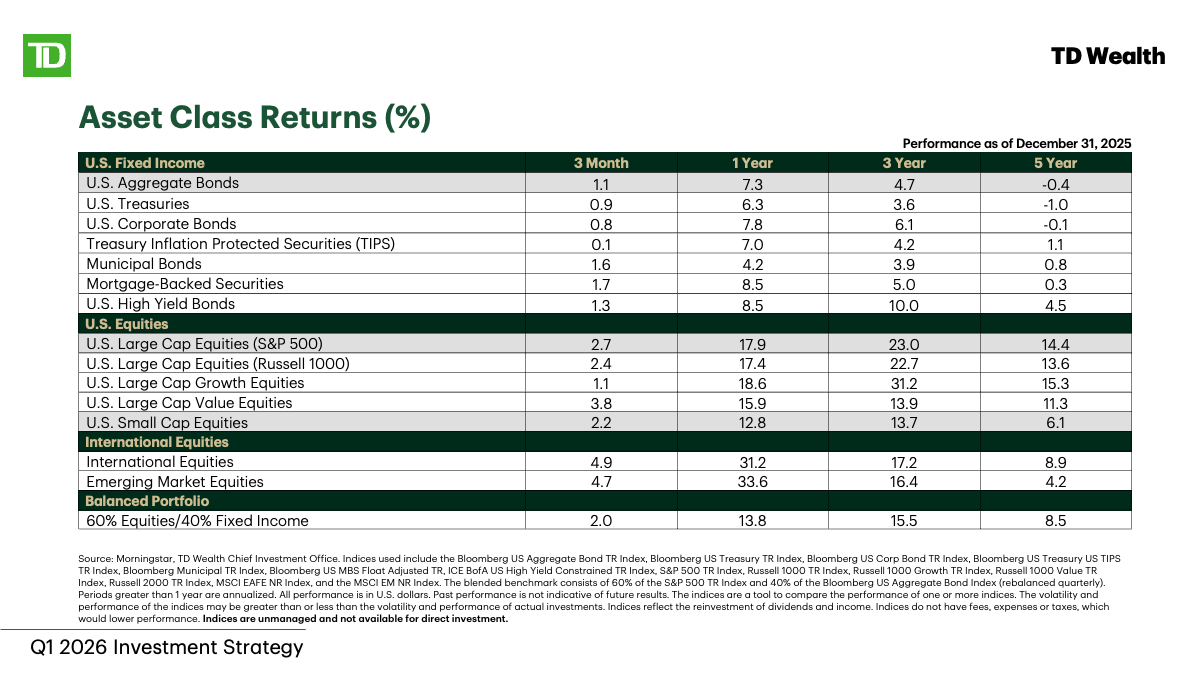

While uncertainty dominated the headlines, 2025 proved to be a strong year for diversified investors. Easing monetary policy and the passage of the One Big Beautiful Bill Act (OBBBA) supported business sentiment and spending, while the impact of tariffs on consumers and companies was more muted than expected. This backdrop contributed to strong performance across global equities, with major subclasses delivering double‑digit gains. The S&P 500 Index rose by ~18%, and all 11 sectors finished the year in positive territory, marking a notable shift from the concentrated leadership that defined more recent periods.

Fixed income markets also posted strong gains, led by high-yield and mortgage‑backed securities, while the broad Bloomberg Aggregate Bond Index advanced by more than 7%. Importantly, diversification once again demonstrated its value, as periods of volatility were often tempered by strength in other areas of the market. This reinforced how staying invested and maintaining a balanced portfolio can help smooth out returns over time and keep investors on track to meet their long-term investment objectives.

Artificial Intelligence Developments: From Providers to Users

Some investors have questioned whether softening momentum among the “Magnificent 7” signals a broader slowdown, but we see this as a healthy market development. For the past three years, a small group of mega‑cap companies have delivered a disproportionate share of the market's overall gains, benefiting from early‑stage AI investment. Towards the end of 2025, however, we began to see market leadership broaden. This was a welcome development, pointing to a healthier, more balanced market.

The benefits of AI are increasingly moving from the large technology providers to the companies deploying these tools, with firms beginning to see real productivity gains and operational efficiencies. This shift highlights an important development within the broader AI theme; one we believe is likely to unfold over multiple decades. The story is no longer limited to a handful of innovators; it is expanding across industries and market segments, which is positive for both the economy and markets.

Positioning Portfolios for the Year Ahead

After three consecutive years of strong equity returns, it’s natural for investors to feel some anxiety around valuations. However, the focus should remain on understanding the underlying forces that will drive the economy and markets moving forward, as the fundamentals remain broadly supportive. Continued monetary easing, AI investment, the economic boost from OBBBA‑related measures, and double‑digit corporate earnings expectations create meaningful tailwinds for 2026.

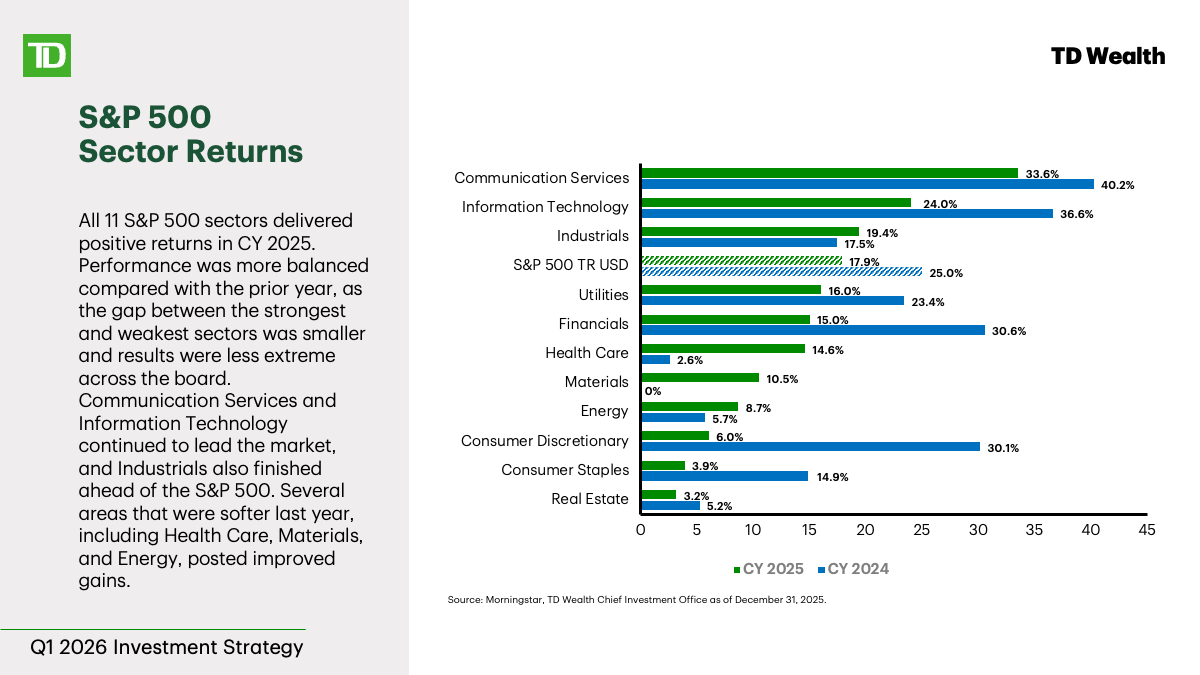

On the economic front, we expect fiscal policy measures to support growth, with Real Gross Domestic Product (GDP) to remain above 2%. Inflation is expected to stay elevated but stable in the 2.5% to 3% range, while labor markets should stay resilient with unemployment holding near 4% throughout the year. With 175 basis points of rate cuts already delivered since September 2024, we expect the Federal Reserve (Fed) to cut two more times, once in the second and once in the third quarter, bringing the federal funds rate to the 3% to 3.25% range.

From a portfolio positioning standpoint, we remain constructive on both equities and fixed income. We have a modest preference for equities and expect U.S. equities to deliver returns in the 8% to 12% range in 2026. The broadening theme in equities is expected to continue, making diversification across geographies, asset classes, and market capitalization an important part of portfolio construction.

Within fixed income, strong corporate health, an easing Fed, and a steepening yield curve support our expectation for a 5% to 7% return, which would represent another solid year relative to historical averages. We see the most attractive opportunities in the short‑ to intermediate‑term segments of the curve, where the impact of additional Fed rate cuts is likely to be most pronounced.

Key Messages for Investors

Markets continued to move higher over the last several years, but the journey has been anything but a straight line. Investors faced bouts of volatility that tested conviction, but those who stayed invested were ultimately rewarded.

When market sentiment turns negative and news headlines create anxiety, it's important for investors to pause and ask themselves whether their financial situation or long-term investment objectives have changed. If they haven't, then it's important to stay invested. Staying anchored to a comprehensive Wealth Plan can help keep investment decisions aligned with long‑term goals rather than short‑term market swings. Remaining patient, disciplined, and focused on long-term investment objectives, especially during periods of uncertainty, continues to be one of the most effective ways to build and preserve wealth over time.

Lastly, investors may wish to use periods of market uncertainty to their advantage. For investors with excess cash reserves, periods of volatility may provide opportunities to deploy capital in accordance with their individual risk preferences, helping to ensure their portfolios are well positioned to support future investment goals.

TD Wealth® Important Information

TD Wealth® is a business of TD Bank N.A., Member FDIC (TD Bank). Banking, investment management and trust services are available through TD Bank. Securities and investment advisory services are available through TD Private Client Wealth LLC (TDPCW), a US Securities and Exchange Commission registered investment adviser and broker-dealer and member FINRA/SIPC. Epoch Investment Partners, Inc. (Epoch) is a US Securities and Exchange Commission registered investment adviser that provides investment management services to TD Wealth. TD Bank, TDPCW and Epoch are affiliates.

Capital market expectations are estimated projections of general market performance and economic conditions and are not intended as an offer or recommendation to invest in a specific asset or strategy or as a promise of future performance. The views expressed are subject to change without notice based on economic, market, and other conditions. Information and data provided have been obtained from sources deemed reliable but are not guaranteed.

The information contained herein is current as of January 2026 and is for educational purposes only. All expressions of opinion are subject to change without notice based on shifting market conditions. It is general in nature and not intended for as a recommendation for any specific investment product, plan, strategy, or other purpose. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

The policy analysis provided in this article does not constitute and should not be interpreted as an endorsement of any political party.

By receiving this information, you agree with the intended purpose described above. Any examples used in this communication are generic, hypothetical and for informational purposes only. TD Wealth® and its affiliates and representatives do not suggest that the recipient take a specific course of action or any action at all. TD Wealth® and its representatives do not provide legal, tax or accounting advice. Prior to making any investment or financial decisions, an investor should seek the individualized advice of their personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's specific situation. TD Wealth® and its affiliates are not liable for any errors or omissions, and you understand that TD Wealth® is not responsible for any loss sustained by any investor who relies on this communication.

Investing in securities involves risk of loss that clients should be prepared to bear. The investment performance and success of any particular investment cannot be predicted or guaranteed, and the value of a client’s investments will fluctuate due to market conditions and other factors. Investments are subject to various risks, including, but not limited to, market, liquidity, currency, economic and political risks, and will not necessarily be profitable. Past performance of investments is not indicative of future performance. Diversification is not a guarantee against loss.

TD Bank and its affiliates and related entities provide services only to qualified institutions and investors. This material is not an offer to any person in any jurisdiction where unlawful or unauthorized. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. All rights reserved. All trademarks are the property of their respective owners. The TD logo and other trademarks are the property of The Toronto-Dominion Bank or a wholly-owned subsidiary, in Canada and/or other countries.

©2026, TD Bank, N.A.