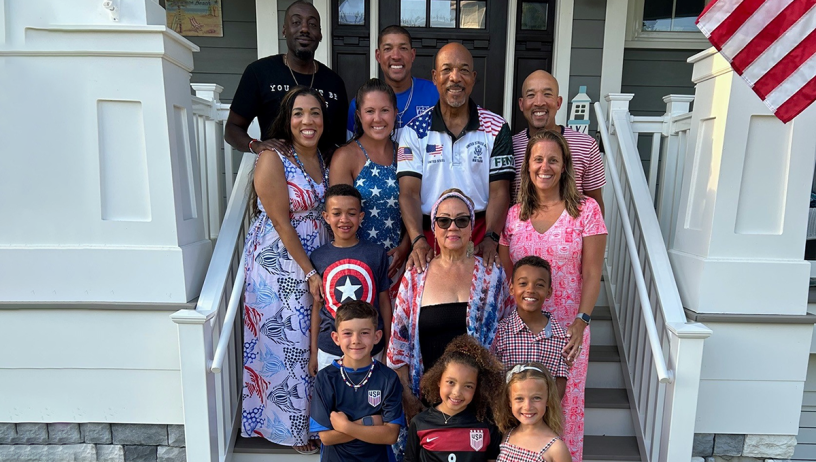

Honoring the Past in New Ways at a Family's Shore House

For Dr. Paris Butler, his family's shore house in Cape May, New Jersey, was the source of so many cherished memories. However, he made the determination over a decade ago that a new direction would be necessary for upcoming generations to make their own memories at the beloved home.

Trending

Media

Join our newsletter

Sign up for the latest updates from TD Stories delivered to your inbox twice a week.